Agribusiness company Wilmar International (SG:F34) and hospitality giant Genting Singapore (SG:G13) from SGX will report their fourth-quarter earnings for 2022 next month.

Analysts expect Wilmar to post positive results based on its leading position in the industry and its capability to post profitability amid the volatile prices of its products. Genting, on the other hand, is expected to benefit from the travel recovery in Singapore.

With the ongoing earnings season in the market, investors can use the TipRanks Earnings Calendar to stay up-to-date. This tool is available across seven different markets, and it presents date-wise updated information about the upcoming results.

Let’s have a look at these companies in detail.

Wilmar International Limited

Wilmar International is a holding company that owns the entire agriculture commodity business through more than 500 manufacturing plants in Asia. The company is known for its huge distribution network, which leads to more synergy and higher margins.

Wilmar will report its fourth-quarter earnings on February 21, 2023. The consensus EPS forecast on TipRanks is S$0.10, as compared to S$0.09 in the fourth quarter of 2021. The company remains confident about posting “satisfactory” numbers for the last quarter.

Despite the volatile prices of palm oil, which is one of its core products, the company reported a 46.3% growth in net profits for the first three quarters of 2022. Analysts believe the plantation sector has better prospects in 2023 and expect it to be less volatile than in 2022. Therefore, Wilmar remains the top choice in this sector, considering its continued investments in new facilities and solid profitability.

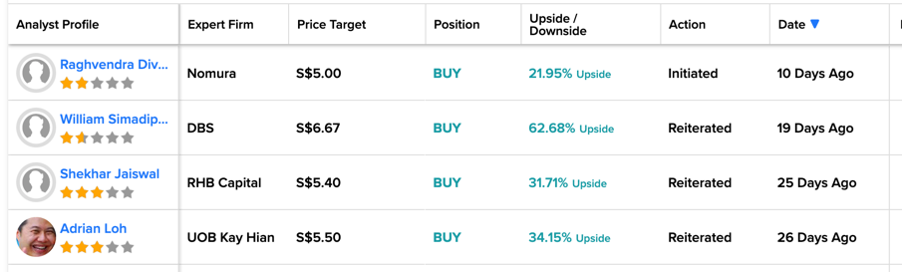

Ahead of its earnings, analysts have reconfirmed their Buy ratings on the stock. Analyst Raghvendra Divekar from Nomura has recently initiated a Buy rating on the stock at a target price of S$5.0, which has an upside of 22%.

Analysts at UOB Kay Hian are optimistic about the stock based on its “integrated business model,” which helps it navigate smoothly among the competition. They also expect palm oil prices to rise in 2023, as global palm oil demand is expected to rise 7.2%, while supply is expected to rise only 3.8%.

Wilmar International Share Price Target

Wilmar’s average share price target is S$5.37, which is 31% higher than the current trading level. The stock has a Strong Buy rating on TipRanks.

Genting Singapore Limited

Genting Singapore is a holding company and operates as a leader in the leisure and hospitality sectors. The company develops and manages resorts and casinos in Singapore.

The company will report its Q4 and full-year results for 2022 on February 20, 2023. Analysts and investors are hoping for positive growth in earnings based on the strong recovery in the Singapore travel sector. Moreover, analysts are highly positive about the company’s Resorts World Sentosa (RWS) as one of the “biggest beneficiaries” of the tourism rebound.

Genting’s EPS forecast on TipRanks is S$0.01 for the fourth quarter. The company’s earnings (EBITDA) in the third quarter were S$249.4 million, which was 143% higher than a year ago. Citi analyst George Choi predicts a 5% increase to S$262 million in the fourth quarter. This shows a 91% recovery as compared to the pre-pandemic levels of 2019.

The expected revenue for the quarter is S$564 million, up from the reported revenue of S$519.7 million in the third quarter of 2022.

Is Genting Share a Good Buy?

According to TipRanks, Genting’s stock has a Strong Buy rating, based on five Buy and one Hold recommendations.

The stock has an average target price of S$1.06, which is 7.5% higher than the current price.

Conclusion

Both Wilmar and Genting are analyst favorites in their respective sectors and are set to recover from the ongoing recovery. The fourth quarter earnings will pave the way for the much higher growth numbers expected in 2023 and beyond.