A smart investor is one who turns to dividend stocks when things get shaky in terms of share prices. The companies that are good dividend payers are mostly the ones with stable earnings and with a commitment to rewarding their shareholders. By investing in such stocks, investors could stabilize their portfolios with dividend income.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Here, we have companies such as Singapore Technologies Engineering (SG:S63) and Oversea-Chinese Banking (SG:O39) from the Singapore market that is popular for their regular dividends.

TipRanks has various tools for investors to choose the right dividend stocks at the right time in any particular market. Top Dividend Stocks could be used to screen the highest dividend-paying stocks; the Dividend Calculator provides a perfect way for investors to look for dividend stocks as per their budget; and the Dividend Calendar provides date-wise information about the companies’ dividends.

Let’s have a look at these stocks.

Singapore Technologies Engineering Ltd. (ST Engineering)

ST Engineering is a Singapore-based technology and engineering company. It serves customers in more than 100 countries and caters to sectors such as aerospace, defense, marine, digital technology, and public security.

The company’s aerospace business was hit hard during the COVID-19 pandemic. However, the company managed to sustain itself smoothly because of its diversified business. In the previous year, the company’s stock fell by 4%.

Under its five-year growth plan, which was announced on investor day in November 2021, the company targets to achieve a revenue goal of S$11 billion by 2026. To achieve this, the company has transformed its business by divesting loss-making units and focusing more on its key growth areas, like commercial aerospace and the smart city segment.

The company’s third-quarter results for 2022 proved the plan to be on track. The total revenue increased by 19% in the first nine months of 2022, and commercial aerospace revenue grew by 25%. The highlight of the results was its new contract wins worth S$4.8 billion in the quarter. As of September 2022, the company’s order book stood at S$25 billion.

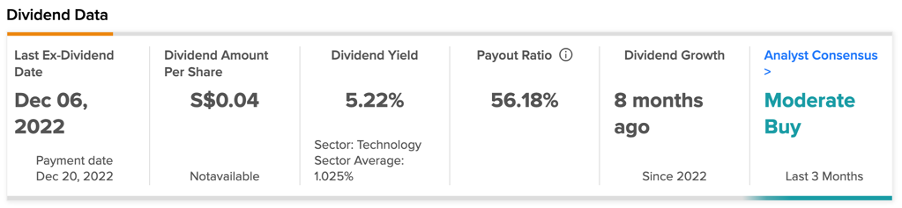

The numbers make the dividend story look more attractive. The company has a dividend yield of 5.2%, as compared to the sector average of 1.02%.

ST Engineering Share Price Target

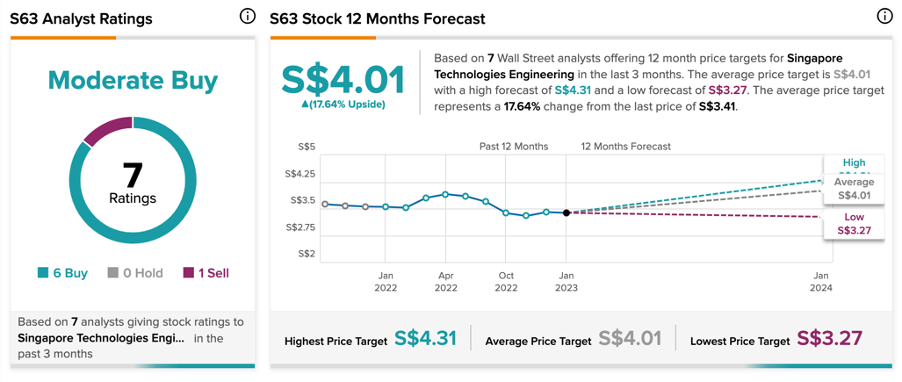

According to TipRanks’ analyst consensus, ST Engineering stock has a Moderate Buy rating based on a total of seven recommendations.

The average price target is S$4.01, which is 17.6% higher than the current price.

Oversea-Chinese Banking Corporation Limited (OCBC Bank)

OCBC Bank is among the oldest banks in Singapore and is among the largest in Southeast Asia. The group provides banking, asset management, insurance, and treasury services in 19 countries.

The company surely made its shareholders happy with its numbers in the third-quarter results of 2022. The net profit in the quarter increased by 31% and reached a new record of S$1.60 billion, as compared to 2021. The rising interest rate helped the bank post a net interest income of S$2.1 billion in the quarter, which was 44% higher than the same quarter of 2021. On the flip side, the wealth management business was impacted due to the reduced investment activities by customers.

Talking about the bank’s dividends, the bank declared an interim dividend of S$0.28 per share, which is 12% higher than the S$0.25 paid a year ago. This brings the bank’s dividend yield to 4.4%.

Is OCBC a Buy Now?

OCBC stock has a Strong Buy rating on TipRanks, based on a full majority of nine Buy recommendations.

The average share price target is S$14.89, which is 18.7% higher than the current price levels.

Overall, the stock has gained 8.3% in the last year and almost 30% in the last three years.

Ending Notes

For an investor to keep their finances more stable, these stocks could be a great option. Regular income via dividends helps the anxious investor stay positive and committed to investing.

For these companies, the strong numbers in their results lay a solid foundation for consistent dividend payments in the future.