Transport company, ComfortDelGro (SG:C52) and food services company SATS Ltd. (SG:S58) will report their quarterly earnings in the following week.

Over the last two years, the operations of these two companies were hit by the pandemic and the subsequent lockdowns. However, now that the travel sector has rebounded, analysts expect the earnings growth to continue in the upcoming quarter’s results.

Apart from some short-term challenges, analysts are optimistic about the long-term growth in share prices.

We have used the TipRanks Earnings Calendar tool to select these two companies for our analysis. This tool provides updated information on upcoming earnings, which can guide investors in making timely and appropriate decisions.

ComfortDelGro Corporation Limited

ComfortDelGro is one of the largest transport companies in the world, with a fleet of around 34,000 vehicles in seven countries.

The company will report its Q4 earnings on February 15, 2023. Analysts have mixed opinions on the earnings and the share price. On one hand, they are optimistic about a strong taxi demand with the removal of lockdowns and more travelers. On the flip side, analysts expect that higher costs and driver shortages will offset the revenue recovery gains.

In its Q3 results, the company posted a 33% jump in its earnings as the operations returned to pre-pandemic levels. But, the company also faced challenges such as a driver shortage and higher inflationary pressures, which are expected to continue in the fourth quarter.

After its Q3 numbers were released, analyst Llelleythan Tan from UOB Kay Hian downgraded the stock from Buy to Hold rating. His downgrade was largely based on the company’s “razor-thin margins” and slower pace of recovery, which could be risky for near-term earnings. His target price of S$1.38 indicates an upside of 15%.

On the positive side, Maybank’s analyst, Eric Ong, remains confident of the company’s recent contract wins in Sydney for S$1.5 billion, which will contribute to the earnings. He has a Buy rating on the stock for its “solid” balance sheet and “strong” free cash flow. He forecasts a 45% upside in the share price.

Is ComfortDelGro a Good Buy Now?

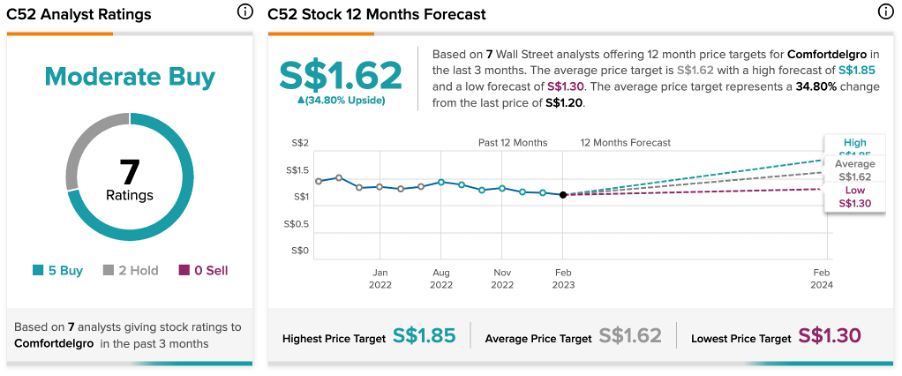

According to TipRanks, ComfortDelGro stock has a Moderate Buy rating, based on five Buy, and two Hold recommendations.

The C52 price forecast is S$1.62, which has an upside of 34.8% on the current price level.

SATS Ltd.

SATS is a food solutions and services company based in Singapore. It provides aviation catering, warehousing, aviation security, institutional catering, and more.

SATS will report its third-quarter earnings for the fiscal year 2023 on February 13.

In its first-half results, the company’s revenues grew by 41.3% to S$804.5 million on a year-over-year basis. The company’s operations are also back to pre-pandemic levels, with flights and passengers at 62% and 56%, respectively. The food business came in at 75% of 2019 levels.

The losses were reduced from S$22.5 million to just S$9.9 million in the first half. The company is expecting them to further reduce in Q3.

Ahead of its earnings, many analysts have reiterated their rating on the stock. Among them, analyst Neel Sinha from CLSA has the highest target price of S$5.0, which has an upside of 62.8%.

What is SATS Stock Price Forecast?

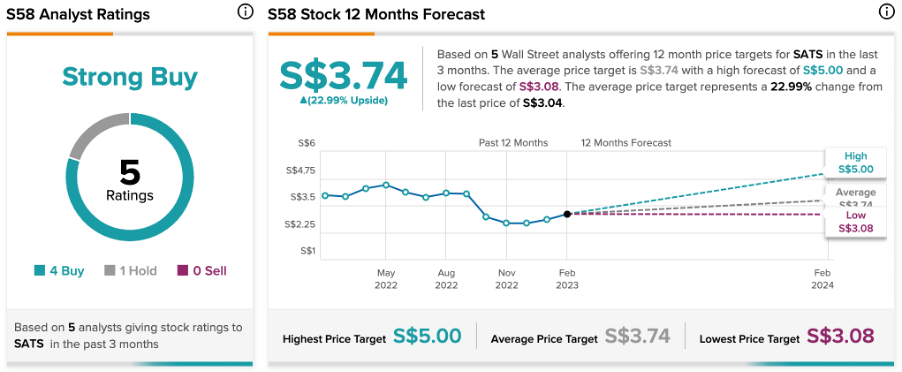

Based on four buy ratings, SATS stock has a Strong Buy rating on TipRanks. The target price is S$3.74, suggesting a change of 23% on the current price level.

Conclusion

With the revival of travel in economies, ComfortDelGro and SATS’ previous quarter numbers indicate that they are on the right track to recovery. The earnings in the next week are expected to be along similar lines, with some pressure on the margins.

Overall, analysts are bullish on the long-term prospects and forecast an upside of more than 20% for both of these stocks.