Shares of British retailer Superdry (GB:SDRY) rallied 118% as of writing on takeover talks. Investors reacted positively to a report by The Times, as per which U.S.-based private equity company Sycamore Partners and Ted Baker-owner Authentic Brands Group have Superdry “on their radar.” Following the spike in the share price, Superdry issued a statement saying that its CEO, Julian Dunkerton, is exploring various options, including making a cash offer to acquire the remaining stake in SDRY. Dunkerton has about 26% stake in the company.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Shares were also boosted by reports that Norwegia-based alternative investment fund First Seagull has built over a 5.3% stake in Superdry.

Superdry in Focus

Superdry disclosed that it formed an independent committee called the Transaction Committee to evaluate Dunkerton’s request to explore the possibility of acquiring the company’s remaining shares.

Dunkerton has informed the committee that he is in talks with potential financing partners to consider strategic options for the company. These discussions are in the initial stages, and no decisions have been made yet.

The CEO has time till 5 p.m., March 1, 2024, to submit a proposal or walk away under the U.K. Takeover Panel’s regulations.

Meanwhile, Superdry continues to work with advisers with regard to various cost saving initiatives. The company has been under pressure due to intense competition in the retail space and the impact of macro headwinds on consumer spending. Recently, the company reported a 23.5% decline in its revenue for the first half of Fiscal 2024, which ended on October 28, 2023.

Are SuperDry Shares a Good Buy?

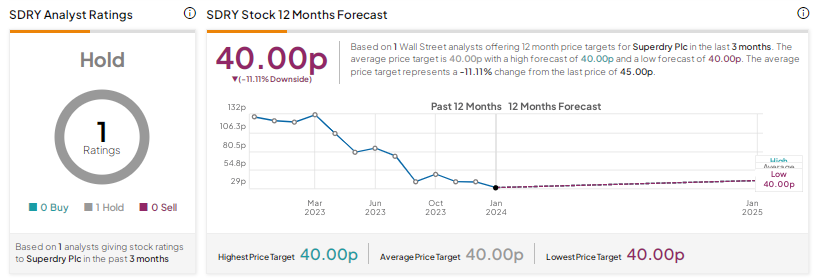

Superdry stock has a Hold consensus rating based on RBC Capital analyst Manjari Dhar’s recommendation. Following today’s rally, Dhar’s price target of 40p indicates a downside potential of 11%.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue