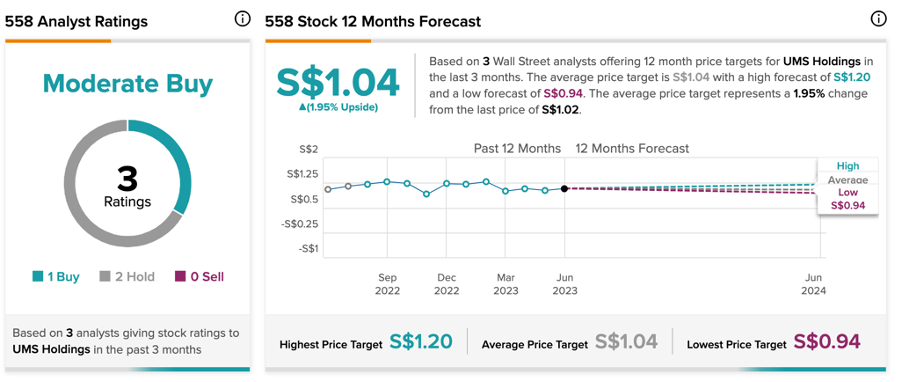

SGX-listed companies Singapore Telecommunications (SG:Z74), Singapore Airlines or SIA (SG:C6L), and UMS Holdings (SG:558) are popular dividend stocks. These stocks are attractive choices for investors seeking extra income within their portfolios.

TipRanks provides a range of tools to assist investors in selecting the appropriate dividend stocks within any given market. Here, we have used the Top Dividend Stocks tool to shortlist these three stocks from Singapore.

Let’s take a look at these companies in detail.

Is Singtel a Dividend Stock?

Singapore Telecommunications Limited, also known as SingTel, is a prominent telecommunications service provider in Singapore.

In 2023, the company declared a total dividend of S$0.099, higher than the last year’s dividend of S$0.093. During the year, the company also announced a special dividend of S$0.025, resulting from its asset recycling initiatives. The company has a dividend yield of 4.74%. During its 2023 earnings, the company affirms its dedication to maintaining ordinary dividends in a range between 60% and 80% of the underlying net profit.

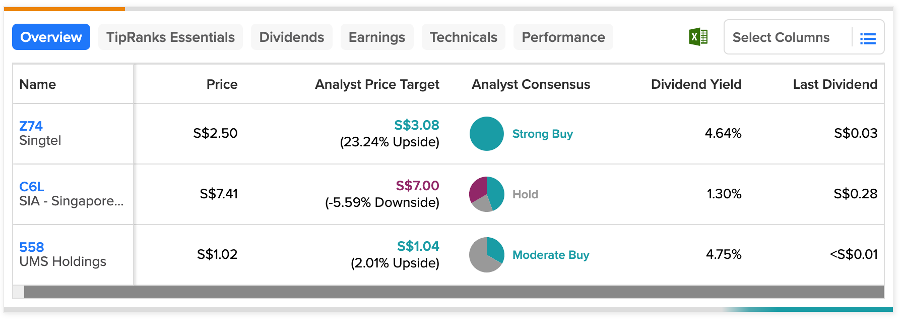

According to TipRanks’ consensus, Z74 stock has a Strong Buy rating backed by all eight Buy recommendations.

The average target price is S$3.08, which is 23.2% higher than the current price level.

Is Singapore Airlines a Good Stock to Buy?

Singapore Airlines, or SIA, is a leading airline in the world and holds the position of the country’s flagship airline.

SIA is experiencing a flourishing business as air travel resumes after being severely hit by the pandemic. The company posted record numbers in its 2023 earnings, and analysts believe it will drive more earnings from the summer season and the travel recovery in East Asia. In 2023, the company reinstated its dividend payments, which were last distributed in 2019. The company’s total dividend for 2023 was S$0.38 per share.

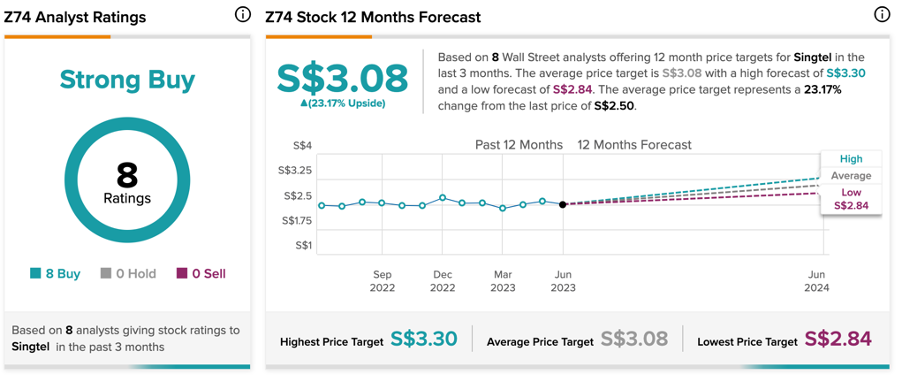

In terms of share price growth, analysts are not forecasting any significant upside as the stock is already trading at higher levels. On TipRanks, C6L stock has a Hold rating based on a total of nine recommendations. The average price forecast of S$7.0 shows a downside of 5.6% in the share price.

What is the Dividend for UMS in 2023?

UMS Holdings is a manufacturing company in the semiconductor industry. The company also caters to other industries such as electronics, machine tools, aerospace, and oil and gas.

The company has a dividend yield of 4.83%, as compared to the sector average of 1.63%. Along with its Q1 2023 earnings, the company declared an interim dividend of S$0.01 per share, maintaining the same level as the previous year.

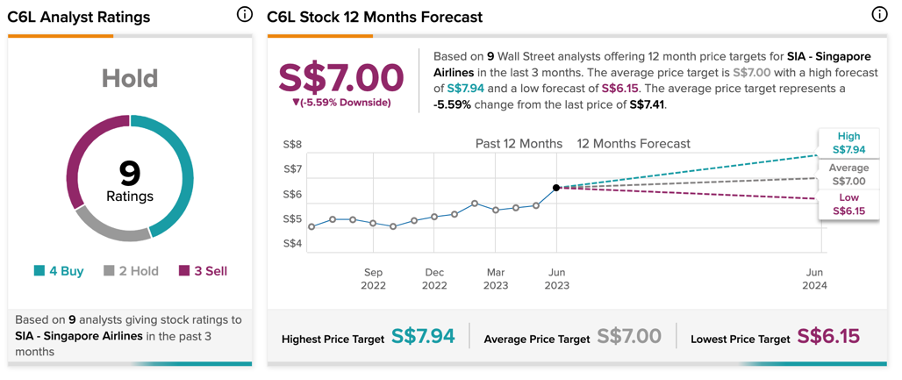

558 stock has a Moderate Buy rating on TipRanks, based on one Buy and two Hold recommendations.

The average share price target is S$1.04, which suggests an upside of 1.95% on the current price.

Conclusion

In the current trading environment, regular dividend income holds significant importance for investors. These three SGX shares are suitable choices that can offer stability to investors’ portfolios.