Germany technology company Siemens’ (DE:SIE) Fiscal first-quarter profit surpassed expectations and reflected the resilience of its business model despite persistent macro pressures and weakness in the automation business. The company maintained its guidance for the full year and continues to expect comparable revenue growth (excluding the impact of currency translation and portfolio effects) in the range of 4% to 8%.

Siemens is a global engineering company focused on intelligent infrastructure, automation and digitalization, and mobility solutions. The company also has a majority stake in Siemens Healthineers, which offers medical technology and digital health services.

Siemens’ Q1 Performance

Siemens’ revenue grew 2% to €18.4 billion in Q1 FY24, with the company witnessing growth in most industrial businesses, including a double-digit increase in Mobility revenue. However, total orders declined 1% to €22.3 billion, as the strength in the Mobility unit was more than offset by lower orders at Digital Industries and Healthineers businesses.

Net income increased 56% year-over-year to €2.55 billion, driven by higher profits in almost all industrial businesses, mainly the Smart Infrastructure unit that gained from solid demand for data centers and power distribution. In contrast, profits of the Digital Industries business declined by 20% due to ongoing pressures in the automation business.

Overall, the company’s revenue lagged analysts’ consensus estimate of €18.68 billion, but net income exceeded analysts’ forecast of €1.69 billion.

The Digital Industries unit’s performance in Q1 FY24 was impacted by continued destocking by customers and subdued automation demand. That said, the company expects that following destocking by customers, the demand in the automation business, mainly in China, could rise again in the second half of Fiscal 2024. It is worth noting that China is the third-largest market for Siemens after the U.S. and Germany.

Meanwhile, as per a Reuters report, two of Siemens’ largest investors, Union Investment and Deka Investment, are pushing the company to simplify its structure and reduce its stakes in Siemens Energy and Healthineers. In response, Siemens said that it would continue to cut its stake in Siemens Energy but would remain the majority shareholder at Healthineers, calling the unit a “very attractive and innovation driven business.”

Is Siemens a Buy or Sell?

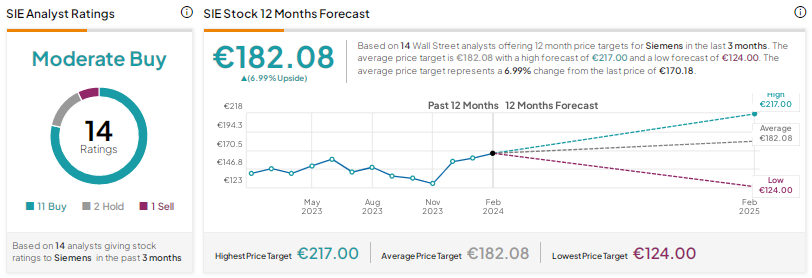

Following the results, seven analysts reiterated a Buy rating on Siemens stock.

With 11 Buys, two Holds, and one Sell, SIE stock scores a Moderate Buy consensus rating. The Siemens share price forecast of €182.08 implies nearly 7% upside.