SGX-listed companies Genting Singapore (SG:G13) and Sembcorp Marine (SG:S51) will release their Q1 earnings for 2023 this week. Analysts are bullish about these stocks and have assigned them Strong Buy ratings in anticipation of the results.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Apart from these two, Thai Beverage Public Co. (SG:Y92), Golden Agri-Resources (SG:E5H), and Singapore Post (SG:S08) from Singapore will also report their quarterly earnings this week.

The TipRanks Earnings Calendar for the Singapore market allows investors to track the scheduled earnings dates of companies. This tool enables investors to examine the forecasted EPS and make comparisons with figures from the previous year.

Let’s examine these companies more closely.

Is Genting Singapore a Good Stock?

Genting Singapore Ltd. operates as an investment holding company involved in the development and management of resorts and casinos. The company will publish its Q1 2023 earnings on May 11. The company is expected to post earnings of S$0.01 per share. The sales forecast for the quarter is S$592.73 million.

G13 stock has a Strong Buy rating on TipRanks at an average price target of S$1.19. The average price target reflects 9.45% growth as compared to the recent price of S$1.09.

Is Sembcorp Marine a Good Buy?

Seatrium Limited, formerly Sembcorp Marine, provides comprehensive engineering solutions to the global marine, energy, and offshore sectors. Ahead of its Q1 2023 results on Friday, May 12, analysts are highly bullish on the numbers considering the company’s significant momentum in the renewable energy sector. The current order book provides the company with revenue visibility for the next three years.

TipRanks rates S51 stock as a Strong Buy based on all six Buy recommendations. The average price target of S$0.17 implies an upside of 33.5% from the current level.

Is Thai Beverage a Good Buy?

Thai Beverage is a prominent player in the beverage industry in Southeast Asia, specializing in both alcoholic and non-alcoholic beverages.

The company will report its second-quarter earnings for 2023 on May 12. The consensus EPS forecast for the period is S$0.01, lower than the EPS of S$0.65 reported in the same corresponding period last year.

Backed by six Buy recommendations, Y92 stock has Strong Buy on TipRanks. The average price target is S$0.84, which is 32.5% higher than the current trading levels.

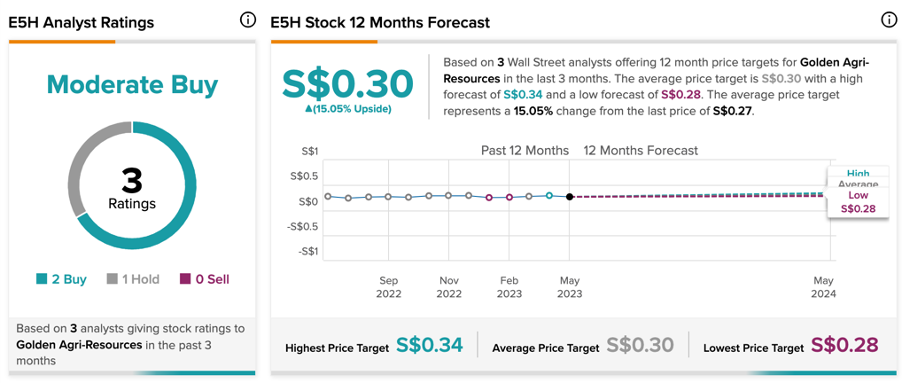

Golden Agri-Resources Target Price

Singapore-based palm oil company GAR will report its first-quarter earnings report for 2023 on May 12. The company is expected to post negative earnings of S$0.01 per share for the quarter.

E5H stock has a Moderate Buy rating at an average price forecast of S$0.30, which implies an upside of 15% on the share price.

Singapore Post Limited

Singapore’s national postal service company, Singapore Post, will report its fourth-quarter results for 2023 on May 11. Analysts expect the company to deliver sales of S$495 million for the period. Despite its strong presence in the postal service sector, the company’s revenues have been affected by the ongoing structural decline experienced by this industry.

S08 stock has one Hold rating on TipRanks from analyst Khang Chuen Ong of CGS-CIMB. At an average price target of S$0.58, he has predicted a growth rate of 13.25% in the share price.