Singapore-based Oversea-Chinese Banking Corp. Ltd. (SG:O39) is a financial and banking services conglomerate that offers an attractive dividend yield of 6.25%. Popularly known as OCBC, the stock is an attractive choice for regular income-seeking investors. Further, as per TipRanks, O39 stock has a Smart Score of Eight, implying that the stock is likely to outperform market expectations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

OCBC is one of the oldest and largest banks in Singapore, with a solid regional dominance. OCBC’s services span consumer/private banking, commercial banking, investment banking, treasury and markets, and insurance solutions. Year-to-date, O39 shares have gained 8.9%.

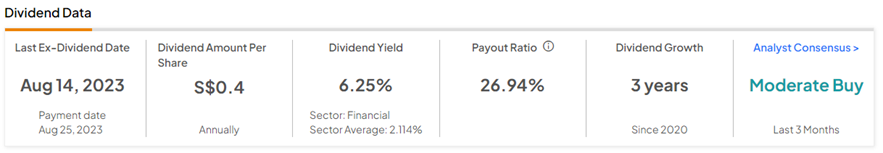

OCBC’s Appealing Dividends

OCBC paid its most recent dividend of S$0.40 per share on August 25, 2023. This semi-annual dividend payment marked a 43% year-over-year increase. The company’s dividend increase is backed by a solid operating performance despite macro headwinds.

During its third quarter Fiscal 2023 results, OCBC’s net profit jumped 21% year-over-year and was 6% higher than the second quarter. The strong performance was attributed to record net interest income and growth in non-interest income. Expanding net interest margins coupled with improved fee income and investment performance drove the bank’s results. Notably, the bank’s non-performing loan (NPL) ratio declined to the pre-pandemic levels of 1%.

Looking ahead, the bank expects macro factors to continue impacting the overall sector. Having said that, OCBC is confident about its strong liquidity, capital position, and ability to steer through the headwinds.

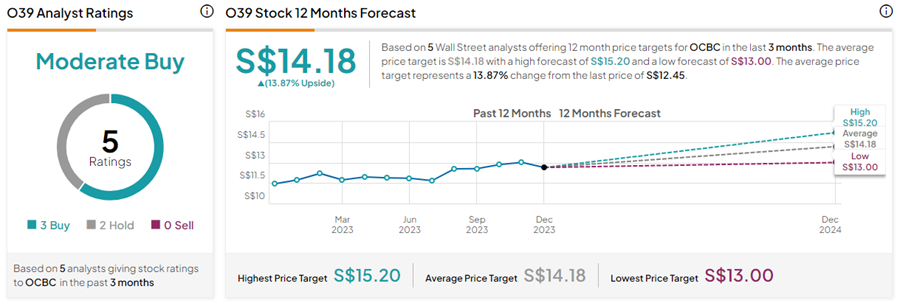

What is the Price Target for OCBC?

On TipRanks, O39 stock has a Moderate Buy consensus rating backed by three Buys and two Hold ratings. The Oversea-Chinese Banking Corp. share price target of S$14.18 implies 13.9% upside potential from current levels.