Shares of ASX-listed Adbri Ltd (AU:ABC) skyrocketed over 32% today following a takeover bid from American building materials provider CRH plc (NYSE:CRH) and Australian private firm Barro Group. The duo has made a cash offer of AU$3.20 per share for taking over Adbri, valuing the firm at AU$2.1 billion. The bid price marks a 41% premium to ABC’s closing price on December 15.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Adbri Ltd is an Australian manufacturer of cement, lime, and dry blended products. Adbri has manufacturing and distribution facilities in South Australia, the Northern Territory, and New South Wales. ABC shares hit a new 52-week high of AU$3.04 in intra-day trading following the news. The deal’s closure is subject to certain regulatory conditions and approval from the Foreign Investment Review Board.

Ireland-based CRH plc is a diversified building materials provider to the construction industry. CRH recently made its NYSE listing as a primary one, converting its listings on the LSE and Euronext Dublin as secondary listings. CRH stock has gained 70.1% so far in 2023. Meanwhile, Barro Group is a family-owned business and an independent supplier and distributor of premixed concrete, quarry products, and a range of associated products.

Further Details About the Deal

Adbri has confirmed the offer and said that CRH and Barro have time until February 28, 2024, to review its documents exclusively. The Barro Group already owns 42.7% of ABC shares, while CRH has a 4.6% stake in Adbri through a cash-settled derivative. Australia remains one of the most promising real estate sector opportunities with the government’s backing. The Australian government has been providing stimulus through the pandemic years and recently added to its housing fund to aid home buyers in new home construction.

Commenting on CRH’s interest in Adbri, CEO Albert Manifold said, “We have held a long-term interest in the Australian construction materials market, which has attractive attributes including stable market dynamics and positive growth prospects.” Manifold believes that the Australian materials market shares the same dynamics as its operations across the U.S. and Europe and is hence seen as an opportunistic market.

Is ABC a Good Stock to Buy?

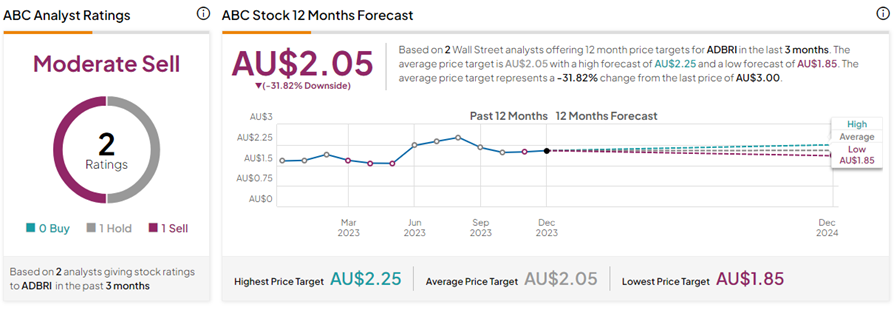

With one Hold and one Sell rating, ABC stock has a Moderate Sell consensus rating on TipRanks. The Adbri Ltd share price forecast of AU$2.05 implies 31.8% downside potential from current levels. It is important to note that these two ratings were given before the news of the takeover bid and are thus subject to change.