Shares of Just Eat Takeaway.com N.V. (GB:JET) surged over 7% yesterday after Bank of America analysts upgraded the stock to a Buy rating from Hold. Plus, the research firm lifted the price target on JET to 1,540p (31.6% upside) from 1,500p. The rating upgrade comes after JET reported a healthy Q4 FY23 trading update on January 17.

Just Eat Takeaway is a Dutch online food delivery company formed by the merger of London-based Just Eat and Amsterdam-based Takeaway.com in 2020. It also acquired American food delivery start-up Grubhub in June 2021 and has been mulling selling off the unit since it has not performed as expected. JET shares have lost 44.3% in the past year.

Here’s Why BofA upgraded JET

Just Eat Takeaway impressed investors with a solid quarterly performance in both the Northern Europe and the U.K. and Ireland segments. The company noted that both these units exited 2023 with the highest-ever quarterly GTV (Gross Transaction Value) levels. Further, the company expects the full-year adjusted EBITDA (earnings before interest tax depreciation and amortization) to exceed guidance and reach €320 million. Plus, JET has become free cash flow positive in 2023. JET will give the outlook for Fiscal 2024 with its full-year 2023 results on February 28.

Bank of America analysts are encouraged by JET’s improved performance and future potential. BofA noted the superior performance from its U.K. and Ireland and the Northern Europe segments, which collectively account for nearly 50% of the group sales. Moreover, the firm is impressed with JET’s strong balance sheet and share repurchase ability.

The firm noted that JET is currently trading at 7.7x its estimated 2024 EV/EBITDA ratio, lower than its peers. Also, its current EV/Sales multiple of 0.6x its 2024 estimates implies that the stock is undervalued.

As per BofA, JET has started to minimize the performance gap with rival Deliveroo (GB:ROO), a positive sign for the company. The analysts are particularly optimistic about future M&A potential now that financials are improving.

What is the Projection for Just Eat Takeaway?

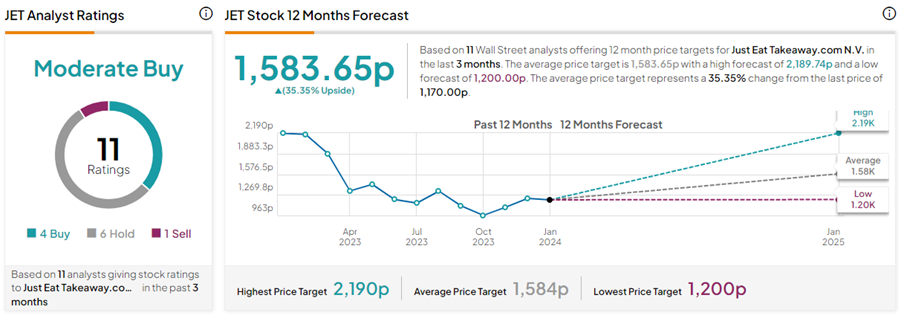

On TipRanks, JET stock has a Moderate Buy consensus rating based on four Buys, six Holds, and one Sell rating. The Just Eat Takeaway.com share price forecast of 1,583.65p implies 35.4% upside potential from current levels.