SGX-listed Lendlease Global Commercial REIT (SG:JYEU) offers an attractive income opportunity to investors looking for high dividends. The company has a dividend yield of 9.03%, positioning it among the leading dividend payers in Singapore. As a real estate investment trust (REIT), Lendlease owns a diversified portfolio of assets in Singapore and global markets, mainly focused on retail and office.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

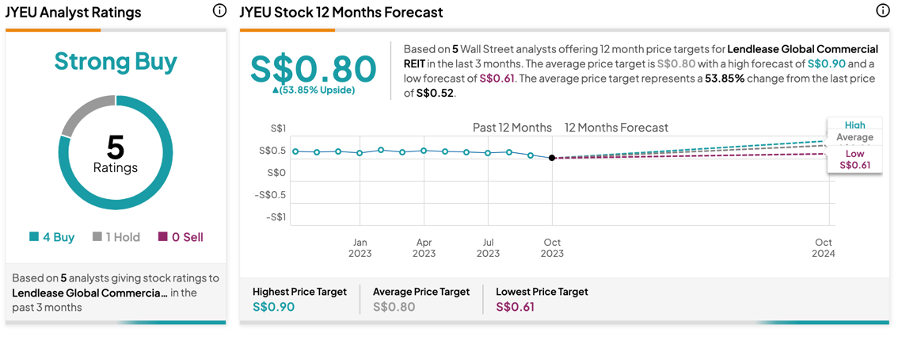

The company also checks the box in terms of capital appreciation. According to analysts, the stock has received a Strong Buy rating with an upside potential of more than 50% in the share price.

SGX-listed stocks have become increasingly popular among investors due to their attractive dividends. For more such stocks, users can refer to the Top Singapore Dividend Stocks tool on TipRanks, which provides a comprehensive list of companies with high dividend yields and comparisons based on key parameters.

Let’s dive into some more details.

Lendlease REIT Dividends 2023

In the second half of FY23, the company posted a decline of 8% in its DPU (distribution per unit) to S$0.0225, as compared to S$0.0245 in the same period a year ago. For the entire year, the total DPU amounted to S$0.047, reflecting a 3% decrease from the S$0.0485 reported in FY2022. This was mainly due to rising financing costs in Singapore, which have had an impact on REITs in the current year. Moving forward, analysts anticipate that DPU will further decline to S$0.0431 in FY24 and will be around S$0.455 in FY25.

Is JYEU a Good Investment?

On the brighter side, analysts are optimistic about the rental recovery of the company’s properties to pre-COVID levels. The revival of tourism is anticipated to positively impact the company’s earnings, consequently ensuring stable dividend payments.

18 days ago, analyst Jonathan Koh from UOB Kay Hian reiterated his Buy rating on the stock, predicting a 60% upside in the share price.

According to TipRanks’ rating consensus, JYEU stock has received a Strong Buy rating, based on four Buy and one Hold recommendations. The Lendlease REIT share price target is S$0.80, which is 53.8% higher than the current price level.