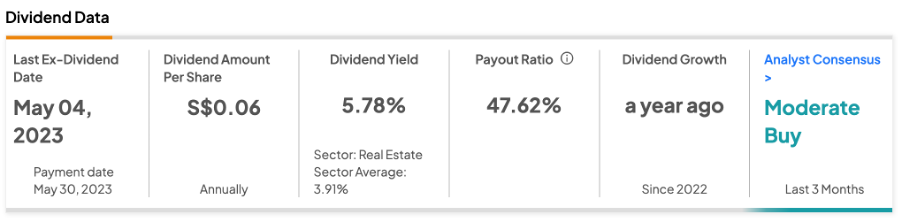

Investors in search of stable income prefer REITs (real estate investment trusts) due to their reliable dividend payouts. SGX-listed Frasers Centrepoint Trust (SG:J69U), with a dividend yield of 5.78%, is one such option for investors seeking high dividends. Frasers Centrepoint is among the top 10 REITs in Singapore and owns around nine retail malls in Singapore. Frasers Centrepoint is managed by Frasers Property Limited (SG:TQ5), which is a real estate investment and management company in Singapore.

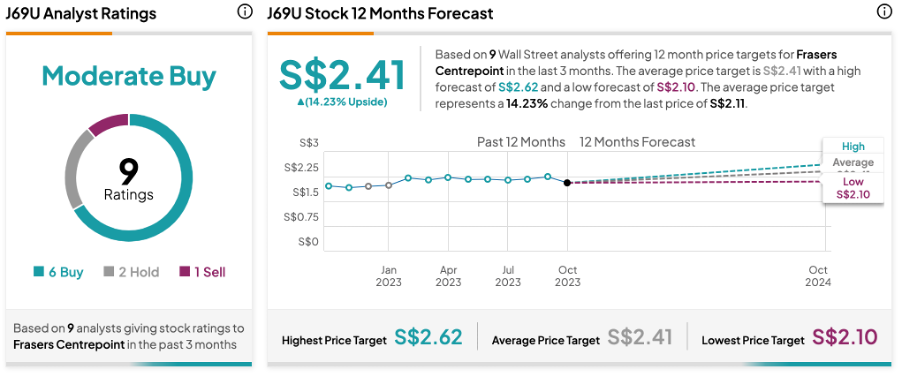

In terms of capital growth, the stock has received a Moderate Buy rating with an upside potential of 14.23% in the share price.

Let’s take a look at some more details.

Frasers Centrepoint Trust Dividends 2023

Frasers Centrepoint distributes earnings to its shareholders semi-annually in March and September every year. In its first-half results for FY23, the company’s DPU (distribution per unit) was flat at S$0.0613, similar to the first half of FY22. The full-year dividend for Fiscal Year 2022 was S$0.122. For the past 16 years, the company has not only consistently paid dividends but has regularly increased its payments, with the exception of the COVID-19-affected year.

Looking at its operational performance, the company witnessed solid leasing demand, driven by more footfalls from shoppers and higher tenants’ sales in Q3 2023. The tenants’ sales were 16% above pre-COVID levels in the third quarter. The trust’s management has stated that it remains committed to increasing tenants’ sales, enhancing the tenant mix, and improving its asset quality to deliver higher value to its shareholders.

Frasers Centrepoint Trust Target Price

According to TipRanks’ rating consensus, J69U stock has a Moderate Buy rating backed by six Buy, two Hold, and one Sell recommendations. The Frasers Centrepoint share price target is S$2.41, which is 14.23% higher than the current price level.