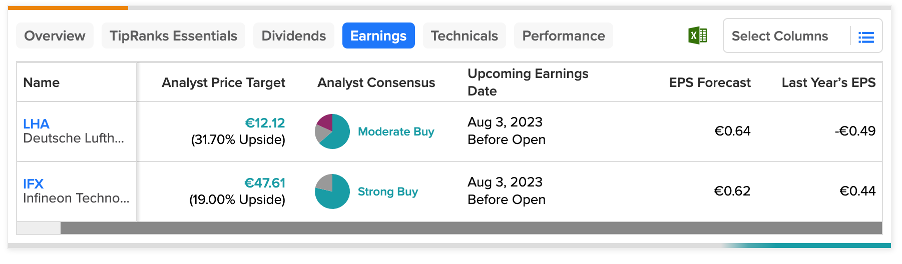

German companies Deutsche Lufthansa AG (DE:LHA) and Infineon Technologies AG (DE:IFX) will announce their next quarter earnings for 2023 this week. Analysts have confirmed their Buy rating on these stocks prior to earnings. According to analysts’ projections, LHA stock presents a notable share price growth opportunity of over 30%, whereas IFX demonstrates a more modest upside potential of 19%.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Let’s take a look at some details.

Deutsche Lufthansa AG

Based in Germany, Lufthansa is the leading airline in Europe with worldwide operations. The company will report its Q2 earnings for 2023 on August 3. According to TipRanks, analysts forecast earnings of €0.64 per share for the quarter. This looks like a significant improvement over the EPS of €0.22 per share reported in the same period a year ago. The forecasted sales for the quarter are €9.74 billion, higher than the previous quarter’s number of €7.02 billion.

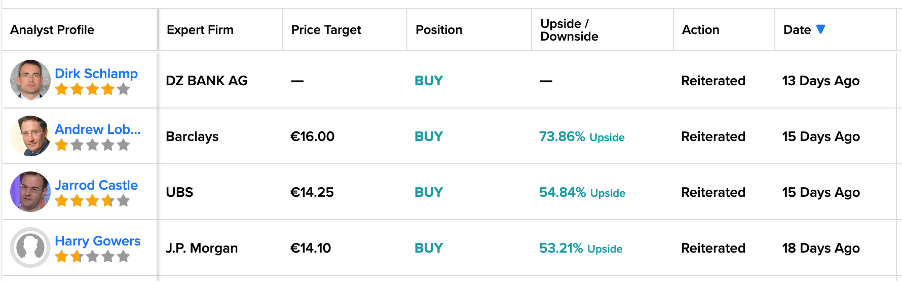

Ahead of the earnings, analysts have expressed their bullish take on the stock. Over the last 15 days, analysts have reiterated their Buy ratings, predicting a huge upside in the share price. Analysts believe the company is showing excellent execution in terms of cost structure, liquidity, and debt management.

Barclays analyst Andrew Lobbenberg predicted the highest growth in the share price of 73% while confirming his Buy rating on the stock.

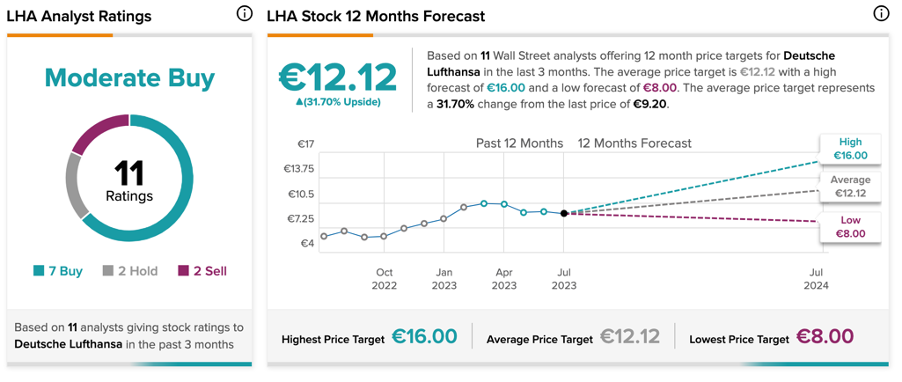

Is Deutsche Lufthansa a Buy?

On TipRanks, LHA stock has a Strong Buy rating with a total of 11 recommendations, including seven Buy.

The average stock forecast is €12.12, which has an upside potential of 31.7%. The target price has a high forecast of €16 and a low forecast of €8.

Infineon Technologies AG

Infineon Technologies is a German semiconductor manufacturing company that serves diverse sectors such as automotive, industrial, telecom, security, and more.

On August 3, the company is set to release its third-quarter results with an EPS forecast of €0.62 per share. In the corresponding quarter of the previous year, the reported EPS was €0.49 per share. The sales forecast for IFX in the upcoming quarter is €4.05 billion, with a range spanning from €4.00 billion to €4.15 billion. In the previous quarter, sales results amounted to €4.12 billion.

The company revised its revenue and margin projections for the entire fiscal year 2023, primarily due to the resilient business dynamics observed in its core automotive and industrial segments.

11 days ago, Kepler Capital’s analyst Sebastien Sztabowicz confirmed his Buy rating on the stock, forecasting an upside of 37% in the share price.

What is the Target Price for Infineon Shares?

According to TipRanks, IFX stock has a Strong Buy rating based on 11 Buy versus three Hold recommendations.

The average target price is €47.61, which represents a 19% change from the current price level.