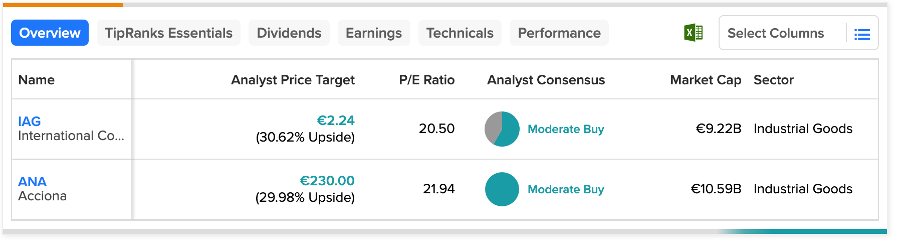

Spanish companies International Consolidated Airlines (ES:IAG) and Acciona (ES:ANA) have earned Moderate Buy ratings from analysts. Moreover, these companies have around 30% growth potential in their share prices for the year ahead.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Let’s have a look at more details on these Spanish stocks.

International Consolidated Airlines Group

IAG is a group company that owns the leading airlines of Ireland, Spain, and the UK and helps them strengthen their market presence.

The company’s stock is still in recovery mode and has yet to reach its pre-pandemic level. YTD, the stock has been trading up by 19%.

Analysts are bullish on the company’s recovery as it is witnessing solid bookings this year. The company is also confident of posting higher profits, driven by an overall rebound in the airline industry after the pandemic. The company expects its operating profit to be in the range of €1.8 billion and €2.3 billion, up from €1.2 billion in 2022.

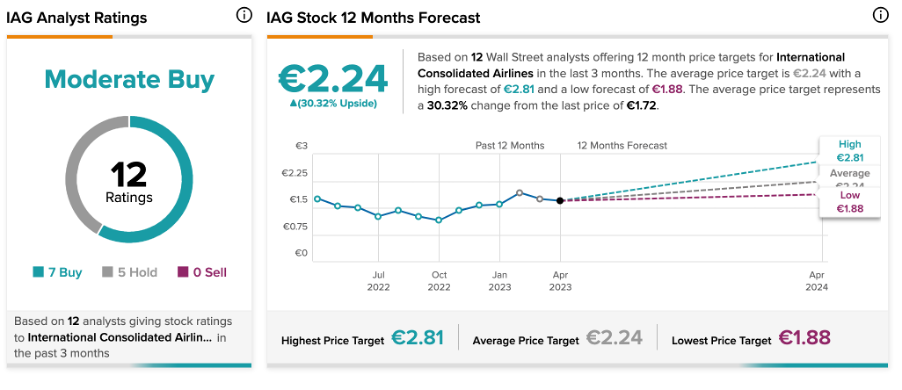

IAG Stock Forecast

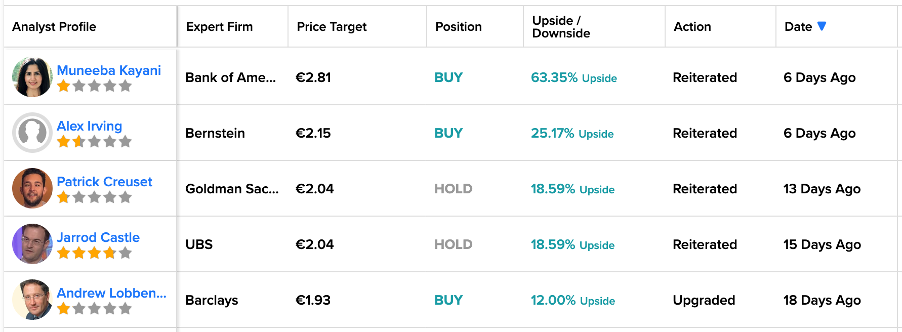

18 days ago, analyst Andrew Lobbenberg from Barclays upgraded his rating on the stock from Hold to Buy. Lobbenberg stated that, despite the ongoing macro headwinds on the airline sector in Europe, “the travel demand will stay strong through the summer.” He added, “IAG will benefit from lower fuel and a weaker U.S. dollar.”

Last week, Muneeba Kayani from Bank of America Securities reiterated her Buy rating on the stock. She predicts a 63% growth in the share price in the year ahead.

Based on a total of 12 recommendations, IAG stock has a Moderate Buy rating from analysts on TipRanks. It includes seven Buy against five Hold ratings.

The average price forecast is €2.24, which indicates a growth of 30% on the current share price.

Acciona, S.A.

Acciona is a multinational company that manages infrastructure projects in the renewable energy space. Over the last three years, the stock has generated a whopping return of 102% for its shareholders.

Moving forward, analysts remain optimistic about the stock, driven by the expected growth in the sustainable energy sector in the European Union.

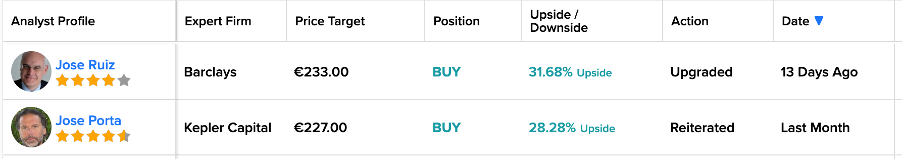

13 days ago, Barclays’ analyst Jose Ruiz upgraded his rating from Hold to Buy on the stock. His price target of €233 suggests an upside of 31% from the current share price.

Last month, analyst Jose Porta from Kepler Capital also maintained his Buy rating on the stock, with a forecast of 30% growth in the share price.

Acciona Share Price Forecast

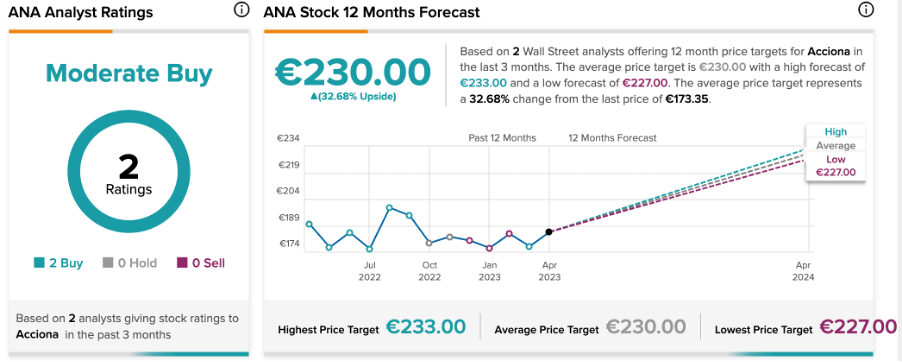

According to TipRanks, ANA stock has a Moderate Buy rating based on two Buy recommendations.

The average price target for ANA is €230, which implies a growth of 32.6% on the current trading levels.

Conclusion

Backed by analysts, IAG and ANA could be good investment options for investors looking for capital appreciation in their portfolios.

Both the stocks have a Moderate Buy rating on TipRanks.