In major news on Hong Kong stocks, Li Auto, Inc. (HK:2015) has postponed its plans to launch pure electric SUV models to next year amid the shortfall of the fast charging networks. The company had previously announced plans to introduce three electric SUVs this year. However, it has now delayed the launch of its electric SUV models until the first half of next year. The Hong Kong-listed shares of Li Auto fell by over 19% today on the launch delay and Q1 earnings disappointment.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

The company released its first-quarter results for 2024 yesterday. The company reported lower profits as higher sales were more than offset by increased research and other operating expenses. The company’s Q1 2024 net income fell by 36.7% year-over-year to ¥591.1 million.

Li Auto is a leading Chinese automobile manufacturer, offering a range of smart electric vehicles (EVs).

Li Auto Sales Lag Expectations

Li Auto disclosed vehicle sales of ¥24.25 billion for the first quarter, marking a 32% increase compared to the previous year. However, this figure fell short of analysts’ expectations of ¥26.71 billion. The company successfully launched four extended-range gas-electric hybrid models but faced disappointment in its first fully electric model, Mega, which did not meet its initial sales expectations.

In March, the company delivered over 3,000 units of the Mega, falling short of analysts’ expectations of 8,000 units per month.

Due to weak interest in its Mega model, Li Auto had to lower its quarterly delivery goal to the range of 76,000 to 78,000 vehicles, down from the original goal of 100,000 to 130,000 units.

EV Infrastructure Demand

During Li Auto’s Q1 earnings call, CEO Li Xiang stated that the company needs sufficient charging stations and additional display areas in its retail shops for a successful BEV SUV product launch.

The company is still lagging behind its competitors in terms of EV infrastructure. As of mid-May, Li Auto had set up over 400 fast charging stations across China. In comparison, Tesla (NASDAQ:TSLA) boasts almost 2,000 supercharging stations in the country, while NIO Inc. (HK:9866) (NYSE:NIO) provides its EV users with over 2,200 fast charging stations and 2,415 battery swapping stations for quick power replenishment.

On the flip side, analysts believe the higher investments to build a much stronger EV infrastructure could potentially impact Li Auto’s profitability.

Is Li Auto a Good Stock to Buy?

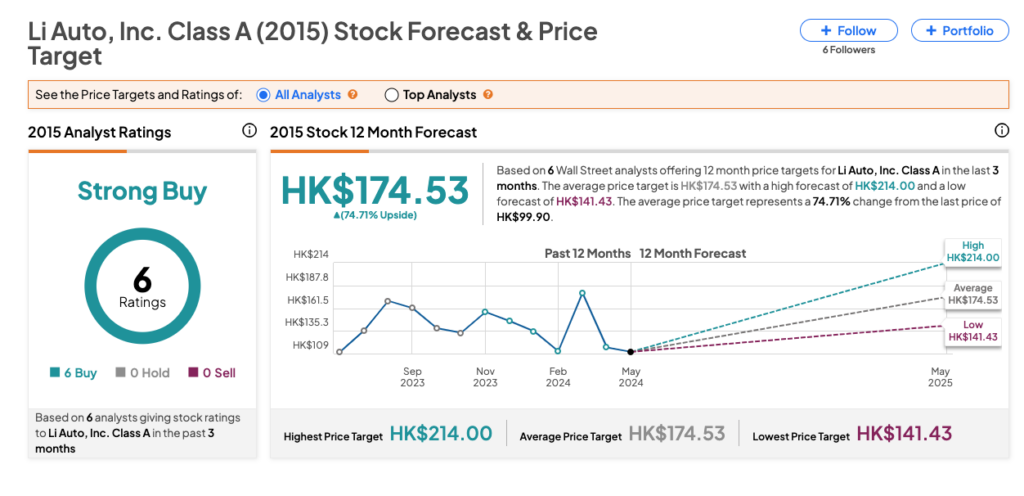

On TipRanks, 2015 stock has been assigned a Strong Buy consensus rating, backed by Buy recommendations from all six analysts covering the stock. The Li Auto share price target is HK$174.53, which is 75% above the current price level.