In major news on Hong Kong stocks, Chinese automaker BYD Co. Limited (HK:1211) has teamed up with French car leasing company Ayvens (FR:AYV) in a move to boost the adoption of its electric vehicles (EVs) in Europe’s corporate market. Through this deal, BYD will be able to offer a diverse, multi-segment range of new energy vehicles to Ayvens’ corporate clients in Europe.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Corporate fleets represent a significant portion of sales in key European markets, further highlighting the significance of this deal. BYD shares gained 0.88% on Wednesday.

Based in China, BYD Co. is among the leading manufacturers of electric vehicles and batteries in the world. Meanwhile, Ayvens is a car leasing unit of French banking giant Societe Generale (FR:GLE) and a leader in sustainable mobility solutions.

Details on BYD-Ayvens’ Partnership

The BYD-Ayvens deal will include new energy passenger cars as well as light commercial vehicles. As per the partnership details, both companies are targeting to serve more than 30 European companies with EV fleet requirements in the first year. The corporate fleet market is crucial to BYD’s efforts to penetrate the European market, where it has struggled to gain traction like its other Chinese counterparts.

Under this deal, operational leasing services will first be available in France, the Netherlands, Belgium, and Luxembourg, with plans to expand into other European markets.

The timing of the deal is ideal, coming just after the EU imposed higher tariffs on Chinese EV imports last month. Starting in July, the EU will impose tariffs of 17.4% on BYD, with an average import duty of 21% for Chinese EV makers. The decision to raise import duties was prompted by an EU investigation, which was launched last year to examine the benefit of import subsidies to Chinese EV makers in the EU.

Is BYD a Good Stock to Buy Now?

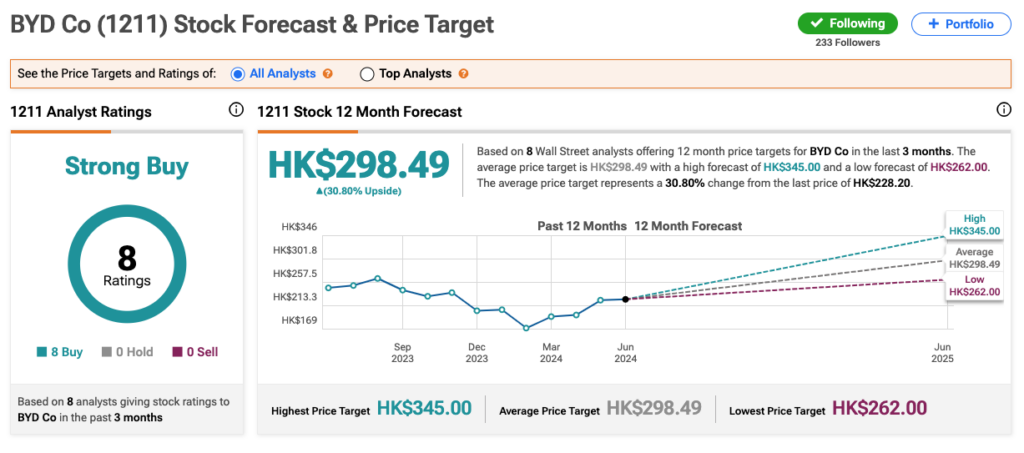

According to TipRanks, 1211 stock has received a Strong Buy rating, backed by all Buy recommendations from eight analysts. The BYD Co. share price target is HK$298.49, which implies an upside of 31% from the current trading level.