Shares of British oilfield services provider Petrofac (GB:PFC) surged nearly 27% yesterday on the news of strategic asset sales. The company is attempting to raise cash to repay bonds that will be due next year. London-based Petrofac is negotiating with financial investors the sale of a minority stake in some of its non-core assets, thus relieving it of short-term obligations.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The company is facing delayed collections on some of its advance payments on new contracts, forcing it to take such extreme steps. The news initially sent Petrofac shares down to a fresh 52-week low, but investors eventually pushed the shares higher on reviewing the long-term prospects. On a negative note, the company said that it will be unable to meet its full-year “broadly neutral free cash flow” target. The news pushed the value of Petrofac’s bonds lower.

Petrofac’s Financial Condition Under Scrutiny

As per reports citing Petrofac’s half-year results, the company has a $162 million revolving credit facility and $90 million in short-term loans that are due in October 2024. Petrofac shares have been under excessive pressure since last week on weakening balance sheet fears. Its shares have lost 33.3% value in the past five trading days alone.

In particular, Petrofac’s Engineering & Construction (E&C) division saw its revenues decline 32% year-over-year in the first six months of 2023. That said, the unit booked massive new orders worth $4.3 billion in the first half.

Petrofac announced the addition of Aidan de Brunner as a non-executive director to the board yesterday. The Board is reviewing all strategic options to strengthen Petrofac’s balance sheet and protect its stakeholders’ interests.

Is Petrofac a Buy?

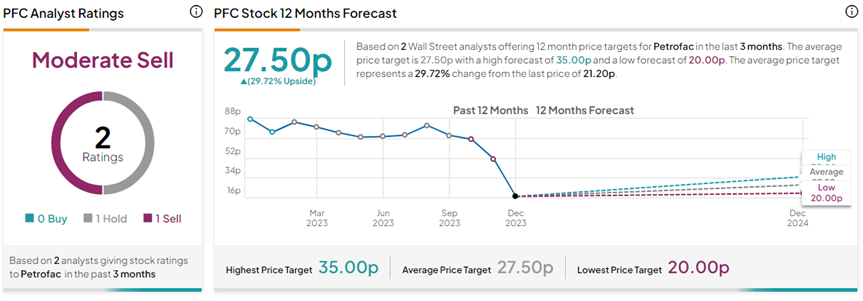

Recently, Jefferies analyst Mark Wilson cut the price target on PFC stock to 20p (5.7% downside) from 80p and maintained a Hold rating.

With one Hold and one Sell rating received during the past three months, PFC stock has a Moderate Sell consensus rating. On TipRanks, the Petrofac share price prediction of 27.50p implies 29.7% upside potential from current levels.