In major news on German stocks, shares of Deutsche Lufthansa AG (DE:LHA) declined by 2% on Monday as the airline braces up for another ground crew strike, potentially impacting travel for over 200,000 passengers. The news comes just two days before the company’s scheduled release of its annual results for 2023 on March 7.

Deutsche Lufthansa is a leading European airline and serves as the flagship carrier of Germany with a global operational reach.

Travel Chaos Looms

In February, major German airports were hit after Lufthansa’s ground crew went on strike twice, demanding higher pay and improved working conditions.

Following unsuccessful talks, Verdi, the labor union representing Lufthansa ground staff, has announced another strike, scheduled on Thursday and Friday. Lufthansa has stated its willingness to negotiate if Verdi is ready to call off the strike. Verdi, representing 25,000 ground staff, is advocating a 12.5% pay increase through these negotiations. It is also seeking an extra inflation bonus for the workers.

Lufthansa criticized the labor union for purposely escalating the dispute and also announced its intentions about a special flight plan.

The next meeting for negotiations is scheduled for March 13 and 14.

What is the Forecast for Lufthansa?

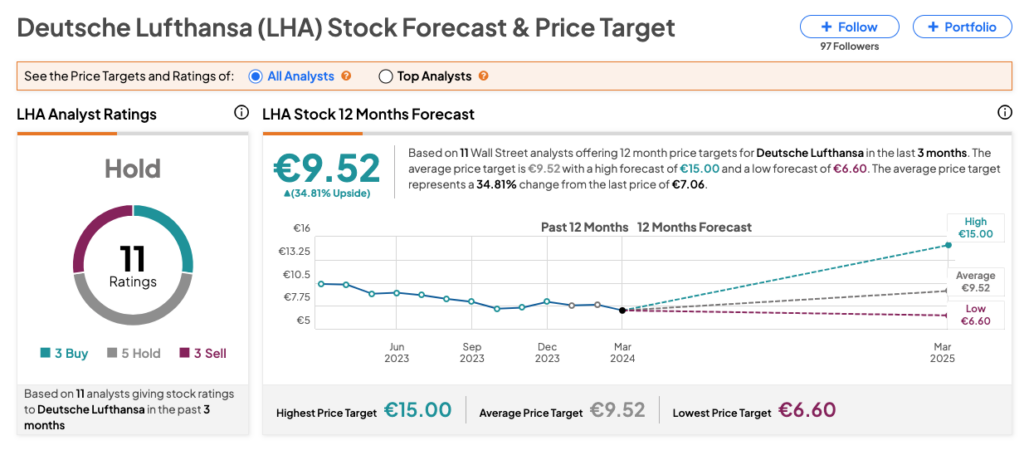

LHA stock has received a Hold consensus rating on TipRanks, with a total of 11 recommendations, of which three are Buys. The Lufthansa share price target is €9.52, which is 35% above the current trading level.