In news on major German stocks, shares of Deutsche Post AG (DE:DHL) (or DHL Group) fell 7% as of writing after the company reported a 25% slump in its EBIT (earnings before interest and tax) to €6.3 billion in 2023. The company further stated that it expects operating profit in the range of €6 billion to €6.6 billion in 2024. Despite the year-over-year decline, the company’s performance was in line with analysts’ forecasts.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Deutsche Post or DHL stands among the largest logistics firms globally, providing postal and logistics solutions both domestically and internationally.

Key Insights

In its annual results for 2023, DHL reported a 13.4% decrease in its full-year revenue of €81.76 billion. The top line was mainly hit by the slowdown in the global economy. Among its segments, Global Forwarding saw a significant drop of 36% in its revenue. The segment was impacted by reduced volumes and a slump in shipping rates globally.

Speaking of shareholder returns, DHL intends to suggest a dividend of €1.85 per share at the upcoming annual general meeting in May. This equates to a dividend payout ratio of 59%, which is near the upper range of the company’s target of 40% to 60%. Moreover, the company has extended its buyback program to 2025, originally planned from 2022 to 2024. It also boosted the buyback amount to €4 billion, adding an additional €1 billion. DHL repurchased shares worth €925 million in 2023.

Is DHL Stock a Buy?

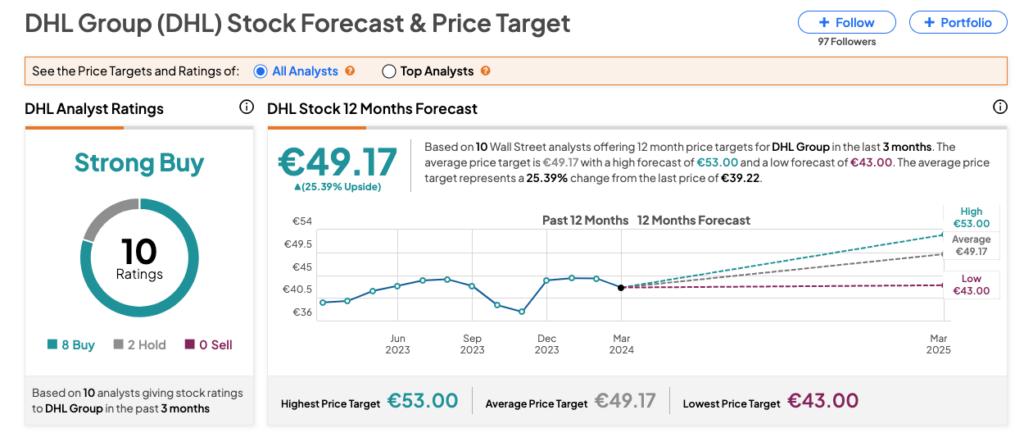

According to TipRanks’ rating consensus, DHL stock has received a Strong Buy rating, backed by eight Buy and two Hold recommendations. The DHL share price forecast is €49.17, indicating an upside of 25.4% from current levels.