In the major news on German stocks, DAX-listed Delivery Hero SE (DE:DHER) shares declined by 5.5% as of writing after the company disclosed that it could be fined by the European Union (EU) for antitrust violations. The company further stated that the fine could be more than €400 million. As a result, Delivery Hero now plans to increase its corresponding provision from the previous amount of €186 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Headquartered in Germany Delivery Hero is a global online food service company operating in more than 50 countries worldwide.

Delivery Hero’s Regulatory Woes

The possible fine that Delivery Hero could face is for an anti-competitive agreement involving terms like sharing national markets, exchanging sensitive business details, and agreements on not hiring any competitor’s employees. In November 2023, the EU announced an investigation into allegations that online food delivery companies colluded with competitors. However, it did not mention Delivery Hero.

Nonetheless, the company is preparing to face these fines after the EU’s surprise inspections in July 2022 and November 2023. These inspections were followed by the company’s recent informal discussions with the EU and subsequent thorough analysis.

The company also assured its full cooperation with the investigations.

Is Delivery Hero a Good Stock a Buy?

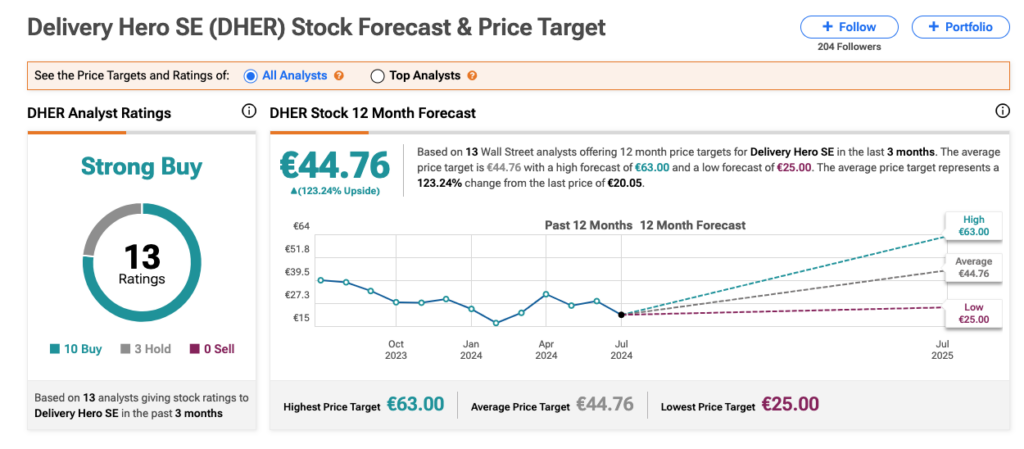

Despite the investigations and a potential fine, analysts maintain a bullish stance on Delivery Hero stock. Today, analysts from J.P. Morgan, UBS, and Barclays confirmed their Buy ratings on DHER stock, predicting upside potential of 97%, 167%, and 152%, respectively.

On the other hand, analysts from Bernstein were not so happy with this development. They think that it could delay the company’s path to achieving a positive free cash flow. Along with the Q1 results in April, Delivery Hero confirmed that it is on track to achieve positive free cash flow in FY 2024.

Overall, according to TipRanks’ analyst consensus, DHER stock has received a Strong Buy rating. The stock has a total of 13 recommendations, of which three are Buy. The Delivery Hero share price forecast is €44.76 which implies an upside potential of 123% from the current trading level.