In important news on German stocks, chemicals maker Bayer AG (DE:BAYN) swung to a loss of €2.94 billion in Fiscal 2023, from a profit of €4.15 billion reported a year earlier. CEO Bill Anderson has chalked out a four-point agenda to turn around Bayer while leaving out the option of splitting the company for now. Following the news, BAYN shares fell 7.6% to hit a new 52-week low of €25.85 yesterday.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Details About Bayer’s FY23 Results

Bayer’s sales also declined 6.1% to €47.6 billion in FY23, owing to lower pricing for its glyphosate-based products. Bayer’s Crop Science unit saw a 3.7% decline in sales, while Pharmaceuticals sales remained flat year-over-year. Only the Consumer Health unit saw a 6.3% increase in sales, thanks to double-digit growth in Dermatology and Pain & Cardio categories.

Meanwhile, the group’s Crop Science unit recorded net special charges of €6.977 billion mainly from huge impairment losses. The full year’s free cash flow fell by 57.9% and net debt increased by 8.5% to about €34.5 billion.

Looking ahead, Bayer forecasts sales between €47 to €49 billion for Fiscal 2024 on a currency-adjusted basis. Furthermore, it expects free cash flow of €2 to €3 billion. Net debt as of FY24 year end is expected in the range of €32.5 to €33.5 billion.

CEO’s Four-Point Agenda

Anderson is determined to delay the break up of the company despite investor pressure to make at least one of the divisions profitable. Although Anderson did not completely rule out the split, he said it was not on the agenda for now.

At the same time, he pointed out four imminent challenges that needed immediate attention. These include strengthening the Pharmaceuticals pipeline as several of the blockbuster medicines are set to lose their patents soon. Next, he wants to address the litigation issues related to the glyphosate-based Roundup weedkiller, which is accused of having cancer-causing effects. Bayer is facing billions of euros in legal settlements related to the ongoing cases of the herbicide.

Anderson’s current focus is also on reducing the company’s debt burden. Bayer is targeting to achieve an A rating on its debt through profitable growth and dividend policy amendment. Bayer has already slashed its dividend by 95% to save €2 billion in cash per year. Bayer had earlier signalled massive job cuts to control costs.

Lastly, Anderson wants to overhaul the company’s operating structure through the implementation of the new Dynamic Shared Ownership (DSO) operating model to make the company more customer-centric and focus on innovation. Anderson said that DSO will reduce the hierarchical structure, cut bureaucracy, streamline operations, and accelerate decision-making meaningfully. Through the new DSO model, Anderson is targetting annual cost savings of €2 billion from 2026. Also, the group will focus on introducing blockbuster products in all three divisions.

What is the Future of Bayer Stock?

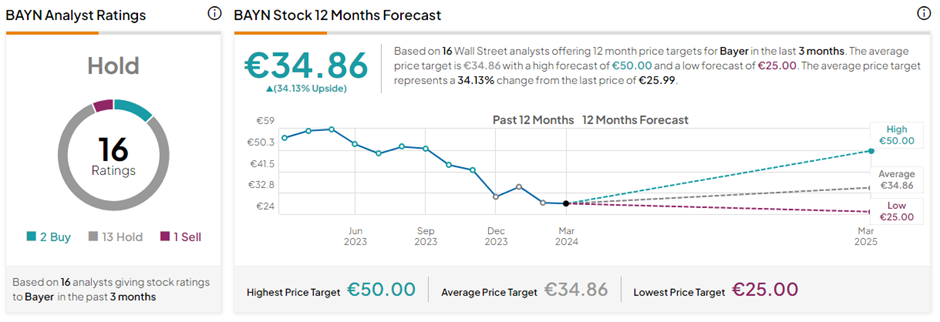

Following the results announcement, four analysts reiterated their Hold rating on Bayer shares while one analyst maintained a Buy rating on the stock.

With two Buys, 13 Holds, and one Sell rating, BAYN stock has a Hold consensus rating on TipRanks. The Bayer AG share price target of €34.86 implies 34.1% upside potential from current levels.