In key news on German Stocks, athletic apparel and footwear company Adidas AG (DE:ADS) has commenced a probe into bribery charges involving certain employees at its Chinese unit, the Financial Times reported. The investigation was triggered by a whistleblower complaint that accused senior staff of taking bribes worth “millions of euros.”

Adidas Investigates Bribery Allegations

Adidas received an anonymous letter on June 7, accusing senior staff in China of receiving kickbacks from external service providers. In particular, the letter mentioned a senior manager who handled the company’s marketing budget worth €250 million per year.

The letter also alleged that another senior manager received “millions in cash from suppliers, and physical items such as real estate.” Reportedly, no employee has been placed on leave currently. In a statement, Adidas confirmed receiving a letter about potential compliance violations and stated that it is conducting an investigation with the help of an external legal counsel.

The allegations come at a time when Adidas is witnessing recovery in its business in the China market after COVID-19-led headwinds severely impacted sales. The company’s business was also impacted by a boycott of Western brands for their decision to not buy cotton from Xinjiang following reports of human rights abuses against Uyghur Muslims.

In the first quarter of 2024, Adidas’ net sales from China grew 8% (on a currency-neutral basis). The company expects to deliver double-digit growth in this key market in 2024.

Is Adidas a Good Stock to Buy?

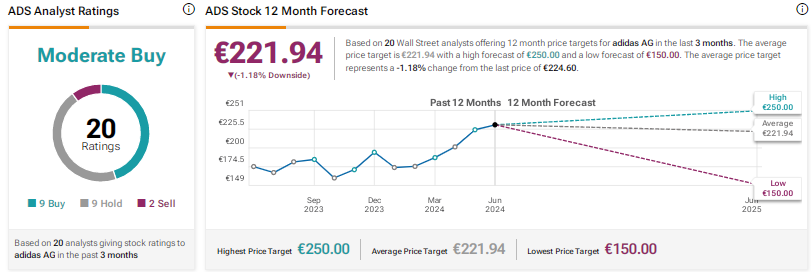

Adidas stock has a Moderate Buy consensus rating based on nine Buys, nine Holds, and two Sell ratings. The average ADS share price target of €221.94 implies a possible downside of 1.2% from current levels. Shares have risen 22.5% so far this year.