In news on French stocks, Thales (FR:HO) surged by 9% on Tuesday after the company reported better-than-expected performance in its 2023 annual results. Sales increased by about 8% (on an organic basis) to €18.4 billion, exceeding analysts’ projections of €18.18 billion. Additionally, operating profit grew by nearly 11% to €2.13 billion, surpassing analysts’ forecast of €2.11 billion. Operating profit exceeded the €2 billion mark for the first time since pre-pandemic levels in 2019.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Investors celebrated the impressive figures, causing the stock to rank among the top performers on the CAC 40 index on Tuesday.

Thales Group specializes in the manufacturing of electrical systems and equipment tailored for the aerospace, defence, transportation, and security sectors.

Highlights from the 2023 Results

During 2023, Thales’ order intake surpassed the €23 billion mark but was down 2% from last year. As of December 31, 2023, the consolidated order book reached a new record high of €45.25 billion, marking an increase of 10% compared to the previous year.

The company’s order intake for the Aerospace division declined by 5% due to a slowdown in satellite orders. Overall, players in the industry are under pressure due to reduced demand for telecommunication satellites and increased competition.

Nonetheless, backed by solid numbers, Thales announced a dividend of €3.40 per share, representing a 16% increase from the previous year. It also aligned with the 40% payout policy based on adjusted net income.

Thales Share Price Prediction

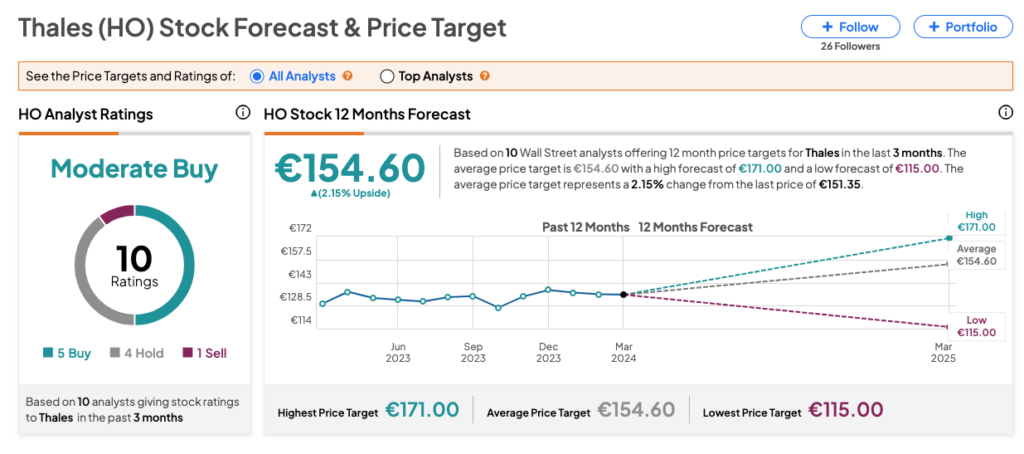

On TipRanks, HO stock has received a Moderate Buy consensus rating, backed by 10 recommendations, including five Buys, four Holds, and one Sell recommendation.

The Thales share price target is €154.60, which is 2.15% higher than the current levels.