France-based L’Oréal S.A. (FR:OR) reported a sales growth of 7.3% on a like-for-like basis, reaching €22.12 billion in the first six months of 2024. For the second quarter, L’Oréal reported a 5.3% increase in its sales to €10.88 billion. However, this marked a slowdown from the 9% growth recorded in the first quarter. The deceleration was mainly attributed to weakness in the Beauty segment in China. L’Oreal shares gained nearly 2% as of writing, as investors cheered the company’s growth outside China.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Based in France, L’Oréal is a global cosmetic brand that offers a wide range of makeup, haircare, and skincare products.

China Weakness Weighs on L’Oréal

In the second quarter, L’Oréal recorded a 2.4% decline in like-for-like sales in North Asia, predominantly in mainland China. This decline followed a 1.1% drop in the first quarter sales. However, it was offset by the company’s favourable performance in other regions. North America saw a 3.4% increase in sales, compared to a 12.3% growth in Q1 2024. Meanwhile, sales from Europe grew 9.7% compared to 12.6% in the previous quarter.

Among L’Oréal’s divisions, growth was led by its Dermatological Beauty segment, which witnessed a like-for-like sales increase of 10.8% in the second quarter. This was followed by the Consumer Products division at 6.7% growth.

Additionally, the company’s operating profit rose by 8.0% year-over-year to €4.6 billion in the first half. This represented a margin of 20.8%, up by 10 basis points compared to the first half of the previous year.

Is L’Oréal Stock a Buy?

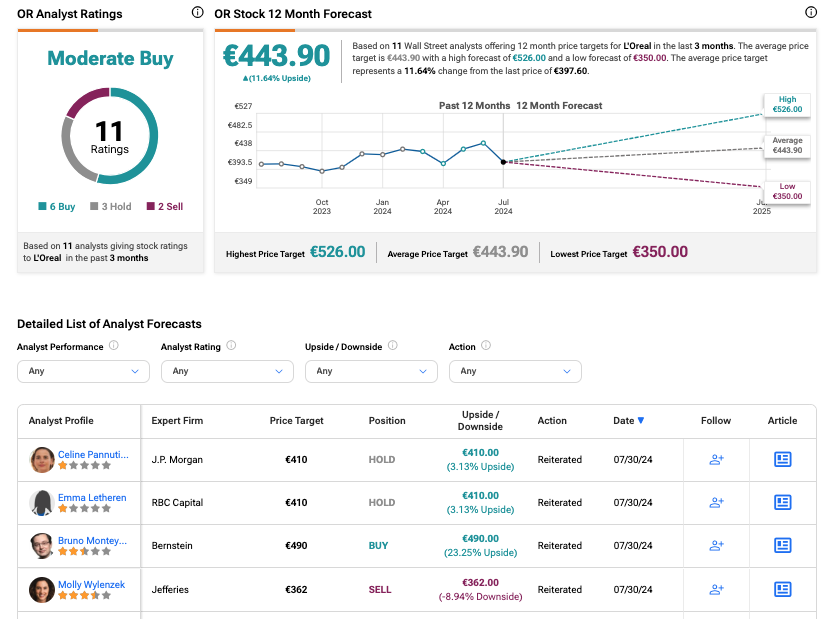

Following the first-half results, analysts gave mixed opinions on LOR stock. L’Oréal stock received two Hold, one Buy, and one Sell rating on Tuesday.

Jefferies analyst Molly Wylenzek, who maintained a Sell rating, stated that regional weakness would remain a concern for the company. She also noted that, although operating margins increased, there was a notable decrease in advertising and promotion spending. This might affect future sales.

Overall, OR stock has received a Moderate Buy rating on TipRanks, backed by 11 recommendations from analysts. The L’Oréal share price forecast is €443.90, which is 11.6% above the current trading levels.