Auto parts supplier Forvia SE (earlier known as Faurecia SE) (FR:FRVIA) announced its plans to cut 10,000 jobs in a move to streamline its operations and adapt to the ongoing shift to electric vehicles (EV). This cut, which accounts for over 10% of its workforce, aims to save approximately €500 million annually starting in 2028. The market reacted negatively to the news, and shares traded down by 12.6% on Monday. Year-to-date, FRVIA stock has lost over 30%.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Based in France, Forvia is a leading manufacturer of equipment for the automobile industry, including seating, interiors, and other mobility systems.

On Track with 2023 Results

Forvia unveiled its streamlining plans alongside its 2023 annual results. Forvia rebounded to profitability in 2023, reporting a net income of €222 million, compared to a loss of €382 million in 2022. This turnaround follows challenges faced in the prior year due to the company’s exit from Russia. Sales grew by 14% to €27.2 billion (at constant currency), while the operating margin saw a 100 basis point improvement to 5.3%.

Over the years, the company has struggled to maintain its margins in Europe, with the region’s 2023 operating margin coming in at 2.5%. Forvia’s staff reduction aims to enhance margins in the European region, where the company grapples with overcapacity issues.

Moving forward in 2024, Forvia is targetting sales growth in the range of €27.5 billion to €28.5 billion, reflecting an increase of up to 4.6%. It further anticipates operating margin to be between 5.6% and 6.4% of sales.

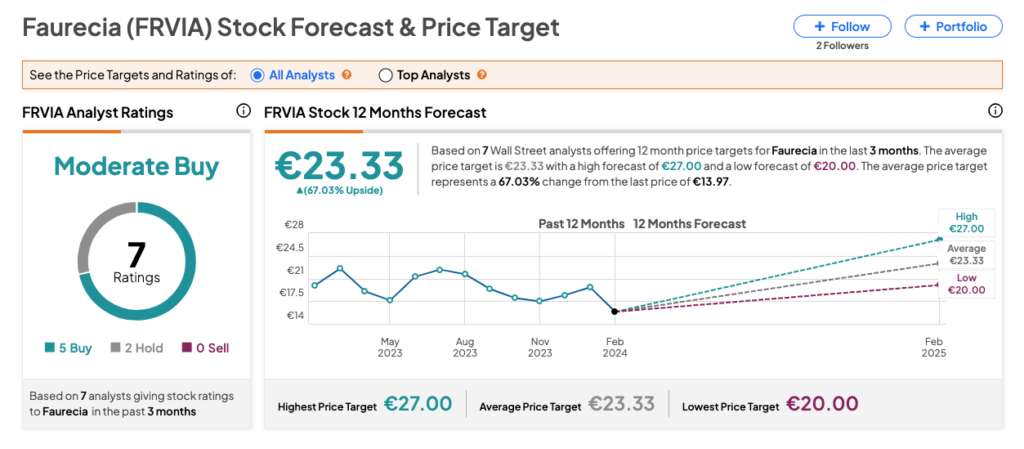

Forvia SE Share Price Target

FRVIA stock has received a Moderate Buy consensus rating on TipRanks, backed by five Buy and two Hold recommendations. The Forvia share price forecast is €23.33, which implies an upside of 67% from the current trading level.