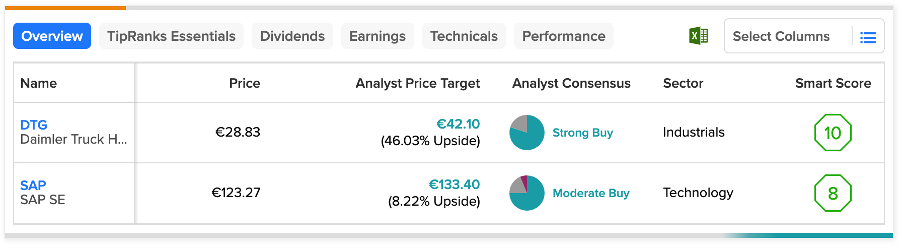

German companies Daimler Truck Holding (DE:DTG) and SAP SE (GB:SAP) have received Buy ratings from analysts. DTG stock presents a notable share price growth opportunity of over 45%, whereas SAP demonstrates a more modest upside potential of around 9%.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

According to the TipRanks Smart Score tool, DTG stock has a “Perfect 10,” and SAP holds a score of eight on ten. This score is assigned after analyzing a stock on eight different factors, including analyst ratings, technical analysis, and more. The scores of eight, nine, and ten imply a higher potential for a stock to surpass the market returns.

Let’s take a look at some details.

Daimler Truck Holding AG

Daimler is a leading commercial vehicle manufacturer that designs trucks and buses in around 40 locations worldwide. The company posted a 25% increase in its Q1 2023 revenues of €13.2 billion. The growth was driven by higher demand for its products and an efficient, stable supply chain in global markets. For the full year 2023, the company is targeting total revenue between €55 and €57 billion.

20 days ago, Deutsche Bank analyst Nicolai Kempf reiterated his Buy rating on the stock at a price target of €45.0. This implies a growth of 56.4% in the share price from the current trading levels. Kempf believes Daimler holds an undisputed position as the market leader in the industry and presents an appealing opportunity to investors.

Similarly, 21 days ago, Jefferies analyst Himanshu Agarwal also confirmed his Buy rating on the stock and predicted growth of almost 40% in the share price.

Is Daimler AG a Good Stock to Buy?

On TipRanks, DTG stock has a Strong Buy rating with a total of 10 recommendations, including eight Buy.

The average stock forecast is €42.10, which has an upside potential of 46.13%. The target price has a high forecast of €53 and a low forecast of €31.

SAP SE

SAP is a German software and technology company that provides a wide range of enterprise solutions. Over the last 10 days, the company’s stock has gained a lot of attention from analysts who have confirmed their Buy ratings.

Seven days ago, analyst Frederic Boulan from Bank of America maintained his Buy rating on the stock with a forecast of 15.5% growth in the share price.

On the same day, Berenberg Bank analyst Nay Soe Naing also reiterated his Buy rating at a price target of €135.0, implying a growth of 9.8%. Naing is a four-star-rated analyst on TipRanks and has a success rate of 89% on this stock.

Deutsche Bank analyst Johannes Schaller also recommends buying this stock and sees an upside of 5.7%.

SAP SE Stock Price Prediction

According to TipRanks, SAP stock has a Moderate Buy rating based on 12 Buy, three Hold, and one Sell recommendations.

The average target price is €133.40, which represents an 8.5% change from the current price level.

Conclusion

Analysts remain bullish on these two shares and recommend buying them. In terms of share price growth, DTG stock offers a higher growth rate of around 46%.