Four days ago, German airline Deutsche Lufthansa AG (DE:LHA) received both Buy and Sell ratings from analysts. In general, the stock holds a Moderate Buy rating on TipRanks. The company’s shares have seen a solid recovery in the last year, with a gain of 54%. Analysts expect the solid passenger demand to continue and believe this is the right time for investors to place their bets on a promising summer season for the airlines.

Deutsche Lufthansa is a prominent European airline that holds a significant position as the national carrier of Germany and has global operations.

New Ratings

Four days ago, Bernstein analyst Alex Irving reiterated his Sell rating on the stock, suggesting a downside of 13.2%.

On the same day, Jarrod Castle from UBS confirmed his Buy rating on the stock at a price target of €14.25. This implies a huge upside of 54.6% in the share price.

Analysts are forecasting a prosperous summer season for the airlines, with China presenting a lucrative market to capitalize on. Lufthansa’s outlook for 2023 indicates a positive margin, primarily driven by robust passenger demand, particularly in Asia and the US. Despite the high fuel prices, the airline possesses the ability to pass on these costs to passengers due to its strong pricing power.

What is the Target Price for Lufthansa?

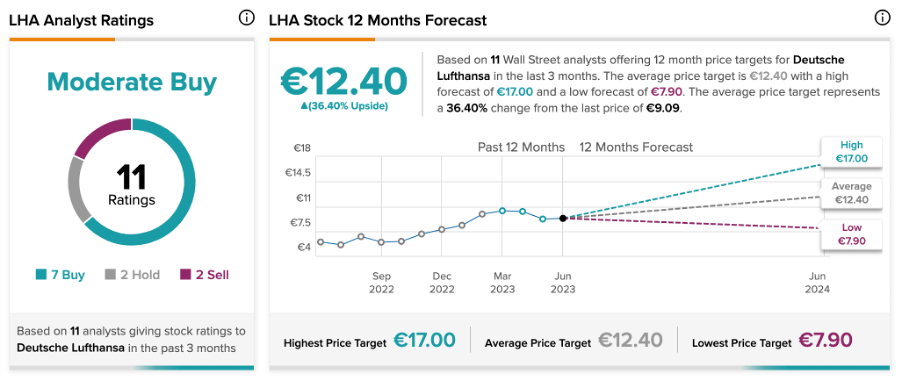

LHA stock has a Moderate Buy rating on TipRanks, with a total of 11 recommendations, of which seven are Buys.

At an average price forecast of €12.40, analysts are predicting a growth of 36.4% in the share price.

Conclusion

The airlines experienced robust demand driven by the global travel recovery and anticipate its continuation throughout the summer holiday season. Analysts believe this will act as a perfect catalyst for the share price as well.