DAX-listed Delivery Hero SE (DE:DHER) recently announced its plans to sell a stake in its Asian business to streamline its operations and focus on profitability. The discussions are in a preliminary stage, and the company has confirmed ongoing negotiations with multiple parties. This includes the sale of its Foodpanda business in selected Southeast Asian markets, like the Philippines, Singapore, Cambodia, Laos, Malaysia, Myanmar, and Thailand. This divestment signals a shift in the company’s focus and presence within the Asian market.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Singapore-based technology company Grab Holdings Limited (NASDAQ:GRAB) has emerged as a potential buyer in the deal. Grab is involved in multiple businesses and is currently a competitor to the company’s Foodpanda business. According to a German magazine, Wirtschaftswoche, Grab is reportedly considering an acquisition deal valued at slightly over €1 billion.

The investors reacted positively to the news, sending the share higher in mid-week. The news lifted the investors’ confidence, which began to wane following a pandemic-induced surge in demand, raising questions about the sustainability of such growth. Year-to-date, the shares have experienced a decline of almost 30%.

Headquartered in Germany, Delivery Hero is a global online food service company with a presence in over 50 countries worldwide.

Analysts’ Reaction

The decision to partially divest its Asian operations aligns with Delivery Hero’s strategy to prioritize investments in markets where it can consolidate its leading position and drive profitability. By narrowing its geographic footprint, the company intends to allocate resources more efficiently and focus on markets with higher growth potential. Analysts are bullish on the deal prospects and expect the share price to grow tremendously.

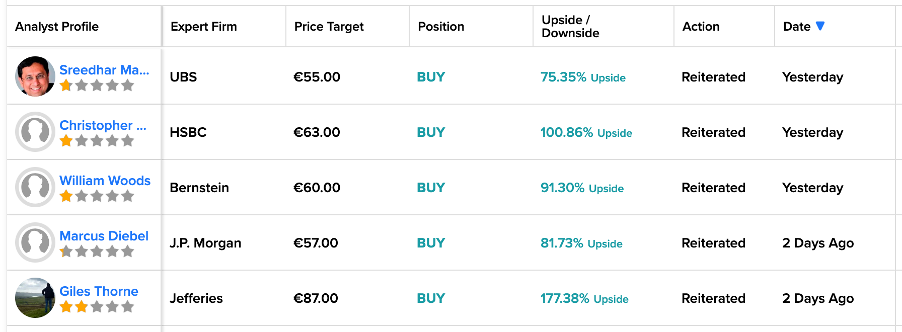

Yesterday, analysts from UBS, HSBC, and Bernstein confirmed their Buy ratings on the stock, suggesting huge upside growth in the share price. Analyst Christopher Johnen from HSBC predicts 100% upside potential in the stock at a price target of €63.

Two days ago, Giles Thorne from Jefferies also reiterated his Buy rating on the stock, forecasting a growth rate of 180%.

Is Delivery Hero Stock a Buy?

Analysts’ forecasts suggest that the stock may offer an attractive opportunity for investors to enter the market.

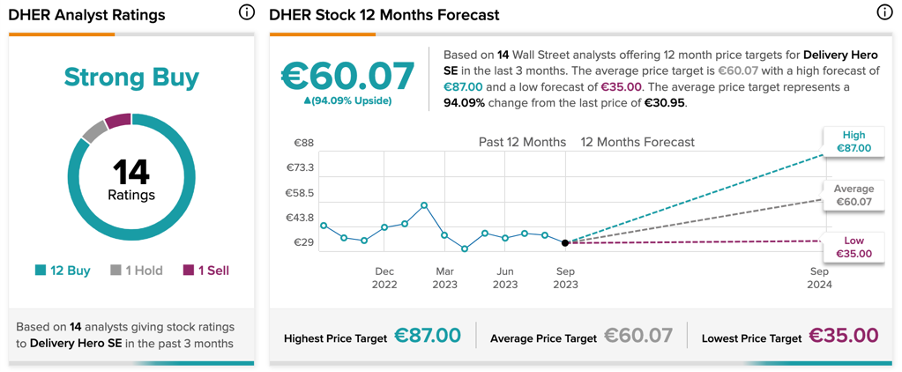

Overall, according to TipRanks’ analyst consensus, DHER stock has received a Strong Buy rating. The stock has a total of 14 recommendations, of which 12 are Buy. The Delivery Hero share price forecast is €60.07, which implies an upside potential of 94% from the current trading level.