The DAX 40-listed Siemens AG (DE:SIE) reported Q4 and FY23 results with record performance in all its industrial businesses. The company rewarded its shareholders, backed by this success, with a higher dividend of €4.7 per share compared to €4.25 a year ago. The company announced record profits in its primary Industrial Business. However, it cautioned about a slowdown in sales growth for the upcoming year. In terms of outlook, the company expects its revenue growth to fall in the range of 4% to 8% in FY24.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The stock started the day on a positive note, registering a gain of over 5% at the time of writing. Year-to-date, the stock has been trading up by 12%.

Siemens AG is a leading engineering and manufacturing company in Europe. The company’s operations are spread across diverse sectors such as energy, finance, healthcare, mobility, automation, consumer products, and more.

Solid Q4 Numbers

In Q4, Siemens posted a revenue growth of 10% on a comparable basis to €21.4 billion. The total order value for the company grew by 6% to €21.8 billion. The order intake included an increased volume from substantial orders in Mobility, coupled with growth in Siemens Healthineers and Smart Infrastructure.

The profits in the Industrial Business witnessed a 7% increase, reaching €3.4 billion, marking the highest quarterly level ever with a profit margin of 16.5%. The company’s segments, Digital Industries, and Smart Infrastructure, also marked their highest-ever quarterly profits.

For the full year 2023, the profit for its Industrial Business jumped by 11% to a record number of €11.4 billion, as compared to the previous year.

Is Siemens a Buy or Sell?

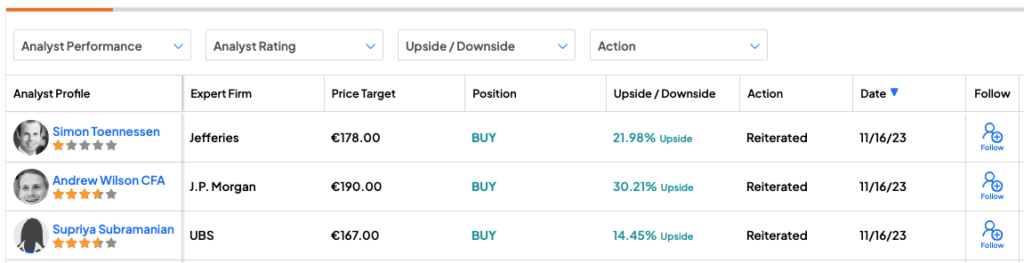

Post-results, analysts at Jefferies, UBS, and J.P. Morgan confirmed their Buy ratings on the stock, predicting more growth in the share price.

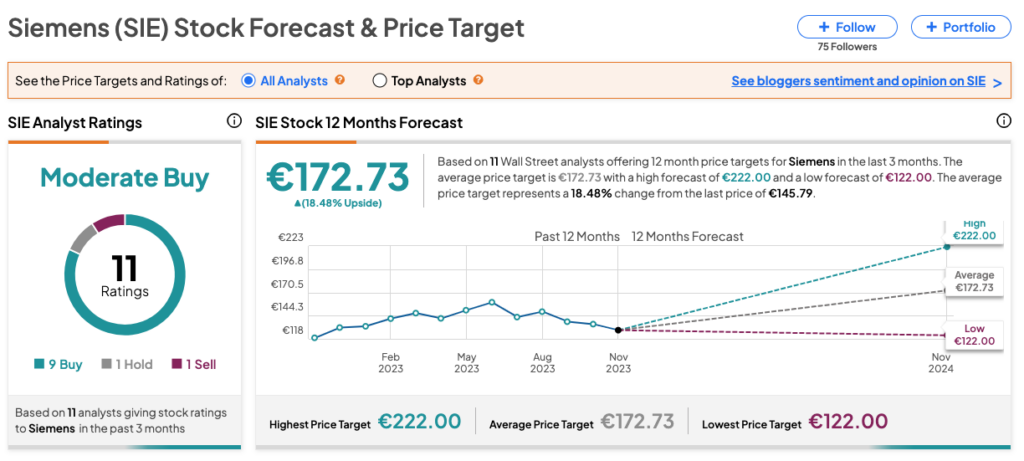

On TipRanks, SIE stock has received a Moderate Buy consensus among analysts, including nine Buy, one Hold, and one Sell recommendations. The Siemens share price prediction for the 12-month period is €172.73, which is 18.5% above the current trading levels.