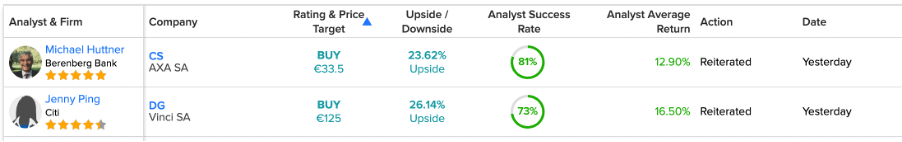

Using the TipRanks Daily Analyst Ratings tool for France, we have identified two stocks, AXA S.A. (FR:CS) and Vinci S.A. (FR:DG), that have been favored by analysts recently. Yesterday, analysts confirmed their Buy ratings on these stocks, positioning them as attractive investment opportunities.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The positive momentum is mainly due to the favorable earnings recently announced by these companies. In terms of capital growth, these stocks, AXA and Vinci, offer around 25% growth in their share prices.

Let’s take a look at these shares in detail.

What is the Forecast for AXA S.A.?

Based in France, AXA operates as a global insurance company, serving more than 90 million customers. The company provides life and non-life insurance, savings, and retirement products.

Earlier this month, the company delivered good numbers in its half-yearly earnings for 2023. The premiums were up by 2% to €55.7 billion, driven by favorable pricing policies in both commercial and retail offerings. The underlying earnings grew by 5% to €4.1 billion. Post-results, many analysts have confirmed their Buy recommendations on the stock.

Yesterday, analyst Michael Huttner from Berenberg Bank confirmed his Buy rating on the stock, predicting a growth of 23.4% in the share price.

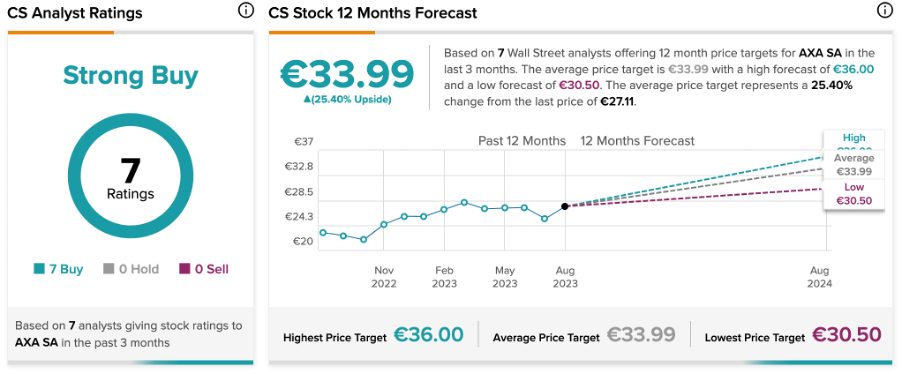

According to TipRanks, CS stock holds a Strong Buy rating, which is based on all seven Buy recommendations. The average price target of €33.9 indicates a potential increase of 25.3% from the current share price.

What is the Target Price for VINCI stock?

VINCI has a strong presence in the concessions, energy, and construction sectors in France. The company designs and makes infrastructure facilities for global markets and also provides maintenance and technical support.

In July, the company reported its first-half earnings for 2023, with growth in all three of its business segments. The total revenues grew by 6.8% to €32.7 billion. The order intake for the period was €31.2 billion, which was 18% above last year’s numbers. The order book stands at a record value of €61.5 billion as of June 30, 2023. Based on these numbers, the company confirmed its guidance for the full year.

The stock received Buy ratings from multiple analysts after the results announcement. Most recently, yesterday, Citi analyst Jenny Ping recommended buying the stock, as she sees a growth of 26.3% in the shares.

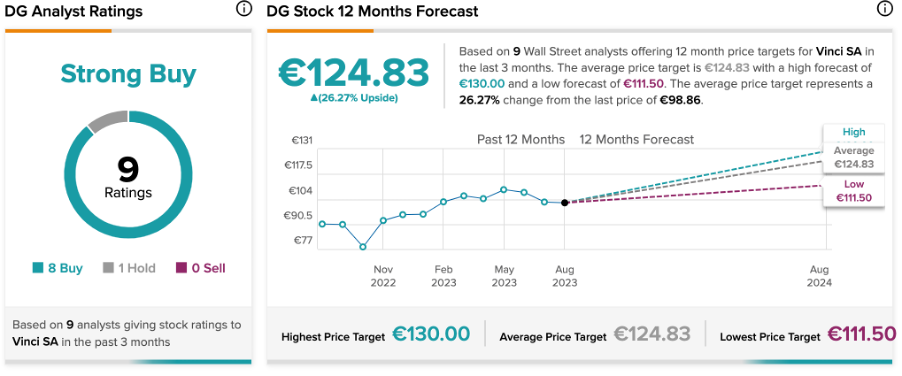

Based on eight Buy and one Hold recommendations on TipRanks, DG stock received a Strong Buy rating. The average price forecast is €124.83, which is 26.2% above the current trading level.

Conclusion

Backed by strong operational performance and Buy ratings from analysts, these French stocks hold the potential to serve as favorable investment opportunities for investors.