Among the trending Australian stocks, Guzman y Gomez Ltd. (AU:GYG) made its debut on the ASX with a stellar IPO on June 20, gaining more than 35% on its first day of trading. According to Dealogic, a UK-based financial content company, the listing marked the largest first-day trading since 2021 and the third best-performing IPO in Australia in the last five years. The remarkable increase on the first day created a buzz around the company and also reflected the favorable sentiment among investors.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Guzman y Gomez was founded in Australia to serve authentic Mexican cuisine. Currently, the company has more than 200 restaurants in Australia, Singapore, the U.S., and Japan.

Guzman y Gomez’s IPO Details

Guzman y Gomez offered 11.1 million shares through its IPO at AU$22 per share. The stock ended its first day of trading at AU$30.28, experiencing solid gains. Due to the increase in share price, the company’s valuation, which initially stood at AU$2.2 billion, surged to AU$3 billion.

The company intends to use the IPO proceeds to support its growth initiatives, particularly expanding its restaurant network in Australia. Additionally, the proceeds will offer significant flexibility to the company to expedite its strategy in case suitable opportunities emerge.

Analysts at Morningstar praised the company’s financial standing and see a huge expansion potential of 40 outlets annually over the next decade. However, they cautioned about certain risks, like intense competition and changing customer needs.

Guzman’s Favourable Outlook

Guzman y Gomez has a proven track record of strong operational performance. Its global network sales of increased to AU$759 million in FY23 from AU$575 million in the previous fiscal year. This was significantly higher than the AU$101 million reported in FY15. Moving forward, the company anticipates that its network sales will reach AU$1.14 billion in FY25.

Additionally, it expects continued sales growth, driven by new restaurants and enhanced sales in existing outlets. Consequently, it forecasts pro forma EBITDA to increase from AU$29.3 million in FY23 to AU$59.9 million in FY25.

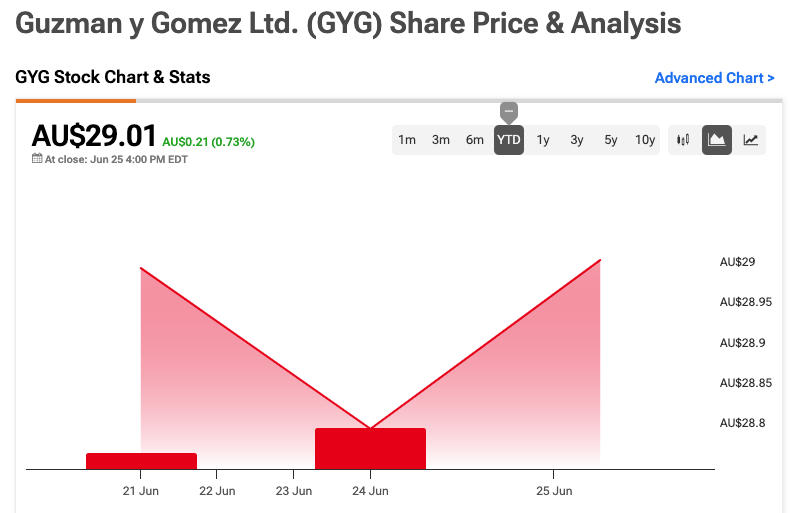

As of June 25, GYG stock has lost over 3.3% of its value since the closing price on the first trading day.