British pharma contender GlaxoSmithKline (GSK) is striving to regain relevance in a field long overshadowed by its rivals Pfizer (PFE) and Merck (MRK). Renowned for its vaccines, respiratory medicines, and HIV portfolio, the London-based company is reviving a shelved therapy with fresh political tailwinds. Its discontinued drug, Leucovorin, is being steered toward a potential fast-track—driven less by clinical breakthrough than by political expediency.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

GSK marketed Leucovorin under its brand name “Wellcovorin” from 1983 to 1997. In an eyebrow-raising moment, Leucovorin has now been reapproved by the U.S. Food and Drug Administration (FDA), spurred by White House pressure to find treatments for autism. Though the drug has shown limited benefit in rare metabolic disorders, its broader use in autism remains unproven and highly controversial—mainly because of who is promoting it the most: the Trump administration. Yet the timing of the approval—announced just before a joint event featuring Trump and Robert F. Kennedy Jr. on autism—highlights how political positioning may carry as much weight as clinical data.

The pursuit of reliable respirators and a viable vaccine during the COVID pandemic should remind investors how rapidly policymakers can move under the appropriate circumstances. As Donald Trump and RFK Jr. prepare a war on autism in the political limelight, GSK managers can be forgiven for thinking they’ve hit two birds without throwing a stone. A dusty old drug is suddenly being reawakened without a dollar being spent, while free publicity is set to follow it all the way to the pharmacy shelves.

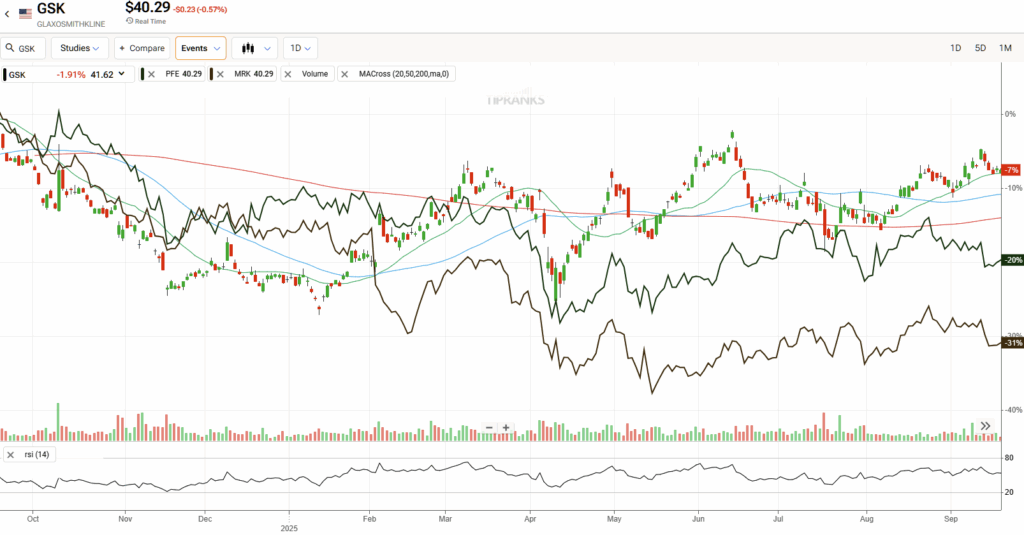

Rangebound GSK Stock Despite Sturdy Results

Despite its strong string of quarterly results, GSK stock has been stuck in a $30-$40 range since 2022. Bears argue that without the stock’s hefty 4.06% dividend yield, which more than doubles the sector average, many investors would have sold up by now.

Third-quarter results highlighted steady growth across all three of its core businesses, with group sales up by 6% and core operating profit increasing by 12%. CEO Emma Walmsley pointed to the “remarkable start” of Shingrix, GSK’s shingles vaccine, which has already seen nearly 7 million doses administered globally.

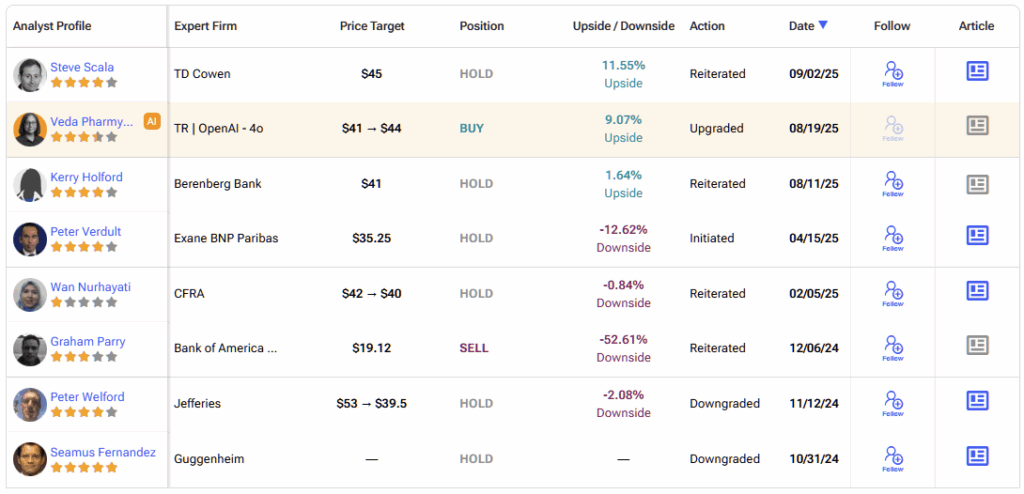

Wall Street analysts aren’t convinced, though. While newer respiratory therapies posted gains, legacy blockbusters like Advair/Seretide continued to decline, and questions linger about whether GSK’s pipeline can truly reinvigorate its pharmaceutical division. Interestingly, Leucovorin doesn’t feature in GSK’s plans, according to TipRanks data. “Confidence is still fairly thin on the ground,” warned Hargreaves Lansdown analyst Charlie Huggins. A snapshot of analyst opinion indicates most analysts remain on the fence regarding GSK.

GSK Pumps Up Its Pipeline

Amid these challenges, GSK is stepping up its bets on growth. Earlier this month, the company unveiled a $30 billion, five-year plan to bolster research and manufacturing in the U.S. The investment includes a $1.2 billion factory in Pennsylvania dedicated to respiratory and cancer drugs, as well as funding for AI-driven drug discovery and expanded clinical trial networks. GSK said the initiative would “bridge R&D and manufacturing across both the U.S. and UK,” thereby strengthening its transatlantic footprint.

The skeptics will likely say the move, timed with U.S. President Donald Trump’s state visit to Britain, underscores GSK’s strategy of leveraging political relationships as much as scientific breakthroughs. Meanwhile, the cynics will say that the approval of Leucovorin was sanctioned by Trump himself and arranged well in advance of this week’s shindig at the UN.

Leucovorin remains the latest, and possibly greatest, sentiment driver for GSK. So too for Donald Trump and RFK Jr. Could GSK’s dusty old drug become the autism-defeater the early hype points to? Probably not, and seasoned biotech investors will know better than to pin their hopes on a wonderdrug. Many have come and lost their shirts doing that.

For GSK, the autism drug is unlikely to become a multibillion-dollar franchise on par with Shingrix. However, it represents something else: a chance to surf the opportunistic wave of political momentum and reframe the company as central to a hot-topic health issue. PR specialists take note. Even better if the incumbent President does early marketing through regular commentary as he achieves lofty political goals. By aligning with Washington’s priorities and expanding its U.S. footprint, GSK aims not only to drive market growth via political favor but also to regain its own relevance. Ultimately, it may be politics rather than science that delivers GSK’s next breakthrough.