General Mills (GIS) stock slipped on Wednesday following the release of its Fiscal Q4 2025 earnings report. The bad news came from its revenue of $4.56 billion, which missed Wall Street’s estimate of $4.59 billion. It was also down 3% year-over-year from $4.71 billion. This was “driven by lower pound volume and unfavorable net price realization and mix.”

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The revenue miss came despite General Mills’ adjusted earnings per share of 74 cents, which was above analysts’ estimate of 71 cents. Even so, investors weren’t pleased that the company’s adjusted EPS dropped 27% year-over-year from $1.10.

General Mills also reported Fiscal 2025 adjusted EPS of $4.21 alongside revenue of $19.49 billion. For comparison, Wall Street expected adjusted EPS of $4.18 on revenue of $19.5 billion. Investors will also note that 2025 adjusted EPS and revenue were down 7% and 2% compared to Fiscal 2024.

General Mills Fiscal 2026 Outlook

Investors also weren’t happy about General Mills’ outlook for its next fiscal year. The company expects adjusted EPS for the period to drop 10% to 15% year-over-year. It also estimates that organic net sales will come in between a 1% decrease and a 1% increase.

The latest General Mills earnings didn’t help GIS stock today. Shares were down 2.45% this morning, extending the company’s 14.53% drop year-to-date. GIS stock was also down 16.77% over the past 12 months.

Is General Mills Stock a Buy, Sell, or Hold?

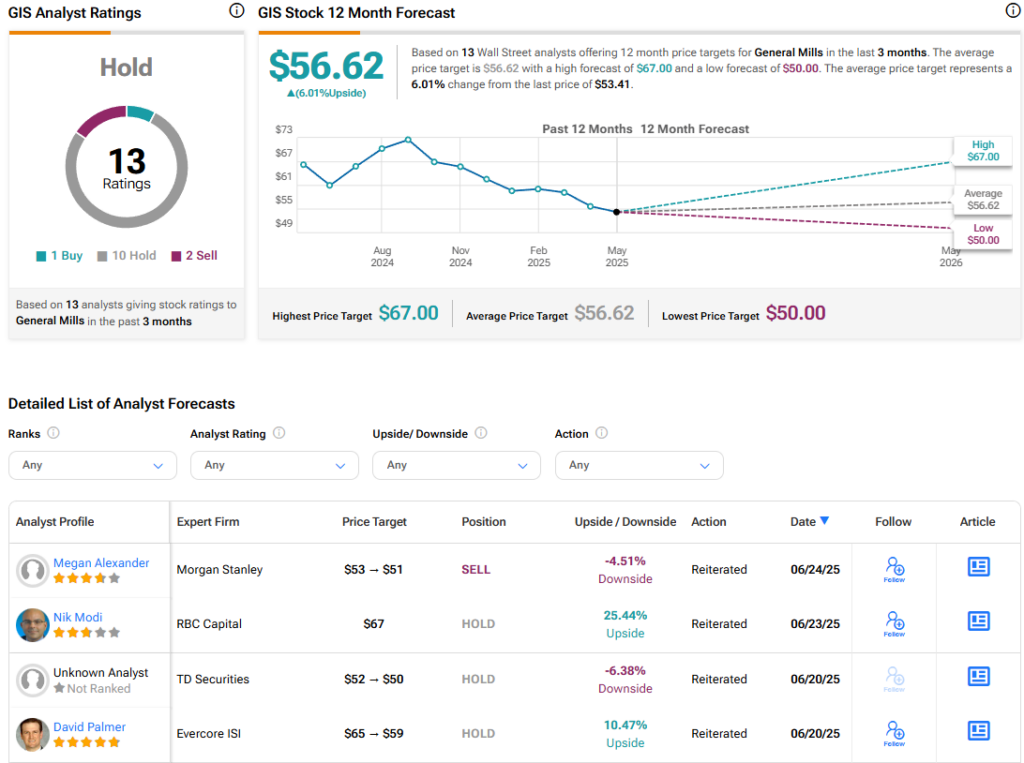

Turning to Wall Street, the analysts’ consensus rating for General Mills is Hold, based on one Buy, 10 Hold, and two Sell ratings over the past three months. With that comes an average GIS stock price target of $56.62, representing a potential 6.01% upside for the shares. These ratings and price targets will likely change as analysts update their coverage of the company after its earnings report.