Shares of General Mills (GIS) fell over 2% in pre-market trading on Wednesday after the company reported its financial results for the first quarter of fiscal 2026. The company reported Q1 sales of $4.52 billion, edging past the $4.51 billion estimate from LSEG. Demand improved after price cuts on select products, yet net sales still dropped 7% year over year, with roughly four points of the decline tied to divestitures and acquisitions.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For context, General Mills is known for household brands like Cheerios, Betty Crocker, and Häagen-Dazs. It produces cereals, snacks, and packaged foods sold in more than 100 countries worldwide.

General Mills Reports Profits

In Q1, operating profit rose to $1.7 billion, up 108% year-over-year. However, it was mainly boosted by a $1.05 billion gain from the U.S. yogurt divestiture. On an adjusted basis, operating profit fell 18% in constant currency to $711 million.

At the same time, diluted EPS rose 116% to $2.22, driven in part by one-time gains. On an adjusted basis, diluted EPS fell 20% in constant currency to $0.86.

General Mills Backs Full-Year Guidance

The Cheerios maker kept its annual sales and profit forecasts unchanged. It expects full-year adjusted profit to drop 10%–15% in constant currency, while organic net sales are projected to be flat, with only a small possible gain or loss.

Importantly, CEO Jeff Harmening said the main focus this year is to get back to organic sales growth. The company plans to achieve this through new product launches, more marketing, and lower prices. Harmening also noted that these efforts are starting to pay off. For instance, General Mills held or increased its volume-based market share in eight of its top 10 U.S. categories.

However, the company cautioned that category growth may fall short of its long-term targets due to a challenging consumer environment.

Is General Mills a Good Stock to Buy?

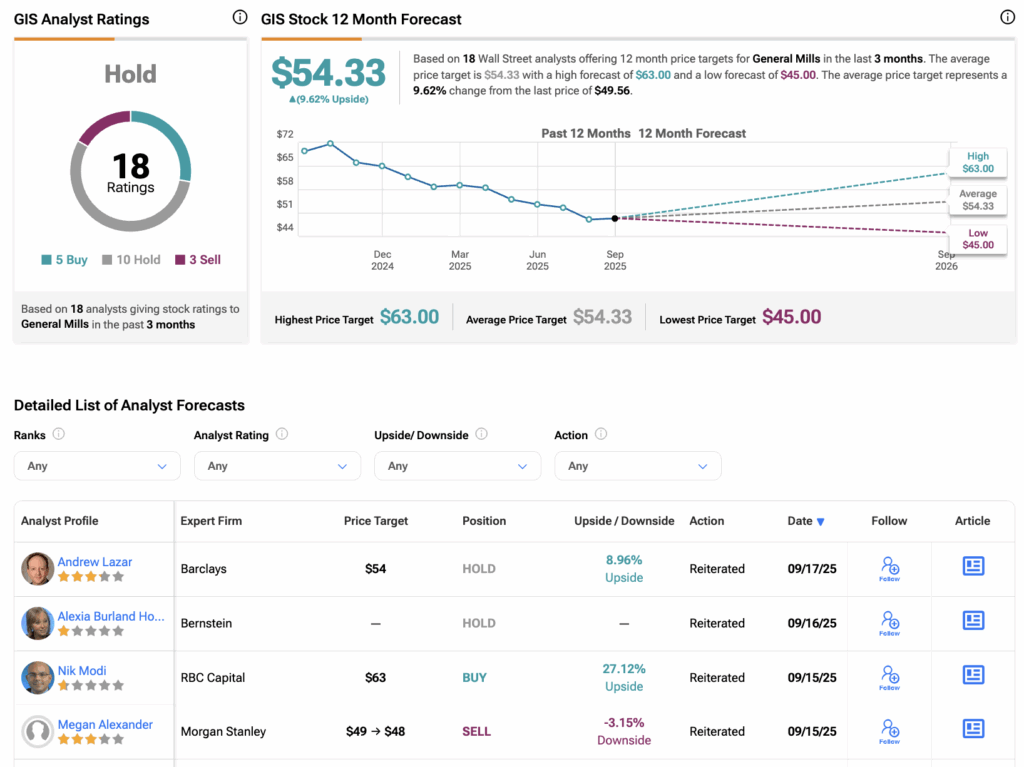

According to TipRanks’ consensus, GIS stock has a Hold consensus rating based on five Buys, 10 Holds, and three Sells assigned in the last three months. At $54.33, the average General Mills stock price target implies a 9.6% upside potential.

It is important to note that these ratings and price targets will likely change as analysts update their coverage following today’s earnings report.