Three large drug companies shared new study results this week that point to more progress in breast cancer treatment. The news came during the European Society for Medical Oncology meeting in Berlin and drew close attention from investors in the health sector. The three companies in focus are Gilead Sciences (GILD), AstraZeneca (AZN), and Roche Holding AG (RHHVF).

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In the meantime, GILD shares climbed 4.21% on the back of the news, while AZN shares rose a modest 1.03%. However, RHHVF shares declined 0.31%.

Gilead’s Trodelvy Shows Progress

First, Gilead Sciences reported that its drug Trodelvy lowered the risk of disease growth in a type of breast cancer called triple-negative breast cancer, or TNBC, by 38%. The study compared Trodelvy with standard chemotherapy in 558 patients who had not received prior treatment for advanced TNBC. These patients also had tumors that did not express a protein known as PD-L1, which means they do not respond to other immune drugs such as Merck’s (MRK) Keytruda.

Patients treated with Trodelvy went about 9.7 months before their cancer worsened, while those on chemotherapy saw progression after 6.9 months. Trodelvy first received U.S. approval in 2020 for patients who had already tried other therapies. Earlier this year, Gilead also shared findings that a combination of Trodelvy and Keytruda reduced the risk of TNBC progression by 35% when used as a first treatment. The company views Trodelvy as one of its key growth drivers as it expands its cancer portfolio beyond its main HIV business.

AstraZeneca, Daiichi, and Roche Present Their Results

In a separate update, AstraZeneca and Daiichi Sankyo (DSKYF) said their new drug, called Datroway, helped extend survival in patients with TNBC. Patients who received Datroway lived a median of 23.7 months compared with 18.7 months for those who received only chemotherapy. The drug also improved the time before the disease advanced, showing consistent benefit across several groups of patients.

Datroway belongs to a new class of drugs known as antibody-drug conjugates. These treatments deliver chemotherapy directly into cancer cells, helping to limit damage to healthy tissue. The therapy is given once every 21 days, compared with Trodelvy’s two-week schedule, which could offer greater ease for patients.

Meanwhile, Roche Holding AG also presented new data for its oral drug giredestrant combined with everolimus. The study showed that the combination cut the risk of disease progression or death by 44% in the main group of patients, and by 62% in patients with a specific gene mutation. The results showed the drug was well-tolerated with no new safety concerns, and the company plans to share the data with regulators.

Investor View

The results from these studies could have a material impact on each company’s top and bottom lines. For Gilead, stronger Trodelvy sales may improve overall revenue mix and enhance margins. For AstraZeneca, additional approvals for Datroway would expand its already dominant oncology franchise and help sustain double-digit earnings growth. For Roche, a new therapy with durable demand could bring fresh momentum to its revenue base after a period of slower growth.

While regulatory and pricing decisions still lie ahead, the new data point to expanding commercial opportunities for all three companies. Investors are likely to watch how each firm converts its clinical success into lasting sales gains and earnings leverage over the next several quarters.

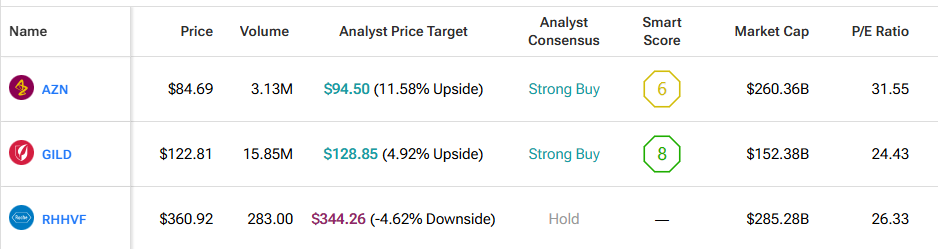

By using Tipranks’ Comparison Tool, we’ve compared all three companies appearing in the piece. It’s a great way for investors to gain a broader perspective on each stock and the pharmaceutical industry as a whole.