GFL Environmental (TSE: GFL) (NYSE: GFL), an environmental services company that offers non-hazardous solid waste management, infrastructure, soil remediation, and liquid waste management services, recently reported its Q3-2022 financial results. GFL’s results beat revenue expectations and matched earnings-per-share (EPS) expectations. The company also raised its revenue guidance.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

GFL’s revenue reached C$1.83 billion (32.6% year-over-year growth, 15.3% organic growth), which beat expectations of C$1.709 billion.

Meanwhile, adjusted earnings per share from continuing operations were C$0.20, in line with estimates, but non-adjusted earnings per share were a negative C$0.55. Additionally, the company’s adjusted EBITDA margin was 25.8% compared to 28% (28.9% on an adjusted basis) last year, but adjusted EBITDA grew 18.4%, nonetheless.

The company also reported adjusted cash flow from operations of C$306.4 million (7.9% growth), with adjusted free cash flow of C$97 million (a ~61% decline).

Notably, GFL raised its full-year revenue guidance again due to its solid Q3 results and the company’s outlook on foreign exchange and commodity prices. For 2022, it expects revenue to be between C$6.6 billion and C$6.65 billion (previously C$6.425 billion to C$6.475 billion), implying about 20% growth. Also, the company reaffirmed its adjusted EBITDA and adjusted free cash flow targets, which are C$1.72 billion and C$665 million at their midpoints, respectively.

Is GFL Stock a Good Buy, According to Analysts?

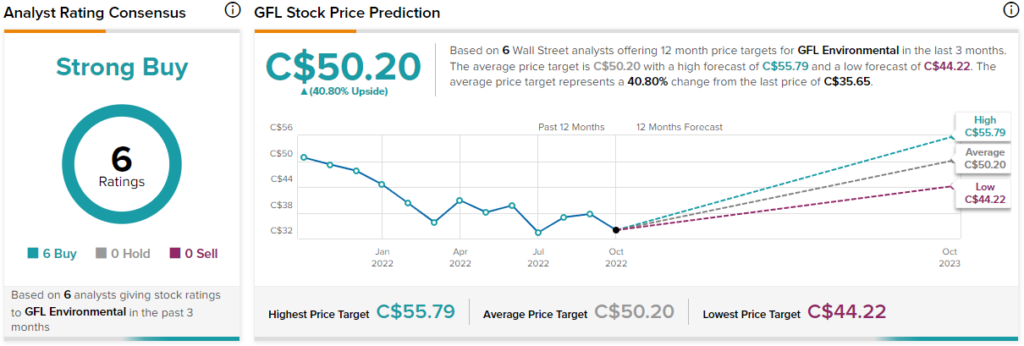

According to analysts, GFL stock comes in as a Strong Buy based on six Buys assigned in the past three months. The average GFL stock price target of C$50.20 implies 40.8% upside potential.

Conclusion: GFL Sees Continued Growth Despite a Worsening Economy

GFL’s results were solid and showed robust revenue and EBITDA growth. The advantage of being a recession-resistant industry such as waste management is that GFL can still thrive in a relatively harsh economic climate. Combine this with analysts being unanimously bullish on the stock, and it makes it worth considering.