Citigroup (C) recently posted its fourth quarter 2024 results, beating Wall Street’s top and bottom line estimates like most of its banking peers. Revenue for the quarter came in at $19.58 billion, a 12.5% year-over-year increase, while earnings per share (EPS) landed at $1.34, topping consensus estimates by $0.12. Citigroup had a successful quarter across all of its segments, notably its wealth and services divisions, which saw excellent fee-based revenue growth. More importantly, the company seems well-positioned for continued growth in 2025 due to a positive industry outlook. This could translate into further share price gains despite its stock surging more than 60% over the last year. As such, I’m bullish on C stock.

Citigroup’s Q4 Results

Banks kicked off earnings season with a bang, delivering impressive results. High interest rates and a strong equities market have created an ideal environment where they are virtually printing cash. Citigroup, with its diversified business model that includes consumer banking and investment banking, has capitalized on these conditions and delivered outstanding performance across the board in Q4.

Specifically, the company posted a 12% increase in revenues year-over-year, with key contributions from its services and markets divisions. Notably, Treasury and Trade Solutions (TTS) and Securities Services saw revenues surge 15%, fueled by higher transaction volumes and fee-based revenue growth. Additionally, wealth management posted a 20% revenue increase, supported by higher investment fees and improved deposit spreads.

The markets division also played a key role, with revenues climbing 36%. Fixed-income markets led the charge, benefiting from increased client activity and a favorable trading environment. Equities markets, meanwhile, posted a 34% revenue jump, driven by substantial cash equity transactions and an uptick in prime balances, as validated by last year’s tremendous rally across major indices.

A Promising Outlook

Regarding its bottom line, Citigroup’s cost discipline significantly contributed to the company exceeding Wall Street’s forecasts. Operating expenses fell 18% year-over-year, primarily due to the absence of prior restructuring charges and savings from management’s organizational simplification initiatives. There was a clear focus on deriving productivity gains, which, coupled with a decrease in credit costs, contributed to $2.9 billion in net income for the quarter, a sharp contrast to the loss recorded in Q4 2023.

But even if we exclude the one-off items from Q4 2022 that led to this loss, adjusted EPS for that quarter was $0.84. Thus, this year’s EPS of $1.34 marks a 60% year-over-year increase. With such strong momentum across the board, Citigroup’s guidance for 2025 appears encouraging, pointing to another strong year ahead. Management expects revenues to grow further, this time by about 3% to 4%, and land between $83.5 billion and $84.5 billion. Key growth drivers include continued market share gains in TTS and Securities Services, bolstered by digital and data capabilities investments.

Further, wealth management is expected to maintain its upward trajectory, with the company focusing on growing client investment assets and boosting banker productivity. With scale and productivity gains kicking in, growth in EPS should be much stronger than the top-line estimate.

C Stock’s Attractive Valuation

As I mentioned in the introduction, C stock has rallied 62% over the last year. And yet, Citigroup’s ongoing momentum and forward estimates suggest that the stock remains attractively priced. With top-line growth expected to persist and margins on an upward trajectory, Wall Street sees 20.5% EPS growth in 2025 and an even more impressive 23.4% growth in 2026.

So, with the stock trading at about 10.7times Fiscal year 2025 EPS, while EPS is likely to actually accelerate from there before potentially normalizing, it’s not far-fetched to assume that the stock will have an easy time moving higher, especially given that, again, industry conditions remain ideal.

Is Citigroup Stock a Buy?

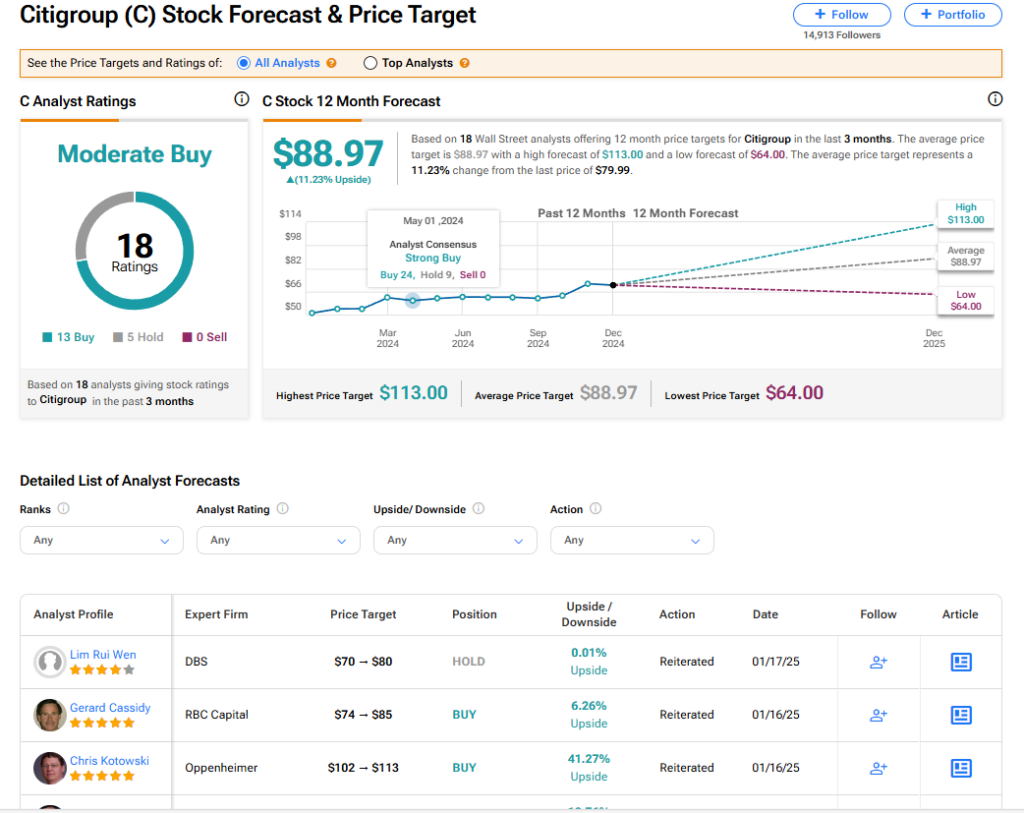

Despite the stock’s sustained post-earnings rally, Citigroup has a Moderate Buy consensus rating based on 13 Buy and five Hold recommendations issued in the past three months. At $88.09, the average C stock price target implies a 10.1% upside potential.

If you have yet to choose which analyst to trust to trade C stock, the most profitable analyst covering the stock (on a one-year timeframe) is Steven Chubak of Wolfe Research. He features an average return of 18.11% per rating and a 71% success rate.

Conclusion

Citigroup’s outstanding Q4 results highlighted its strong top and bottom-line momentum, with 12.5% revenue growth and a 60% year-over-year EPS increase driven by excellent performance across wealth management, treasury services, and market divisions. Cost discipline led to further strengthen in its margins. Management expects enduring revenue growth this year, which Wall Street expects to translate into 20% EPS growth, supported by market share gains and productivity improvements. Therefore, despite a 62% rally over the past year, I believe C stock remains poised for further gains, especially given its attractive valuation.

Questions or Comments about the article? Write to editor@tipranks.com