U.S. markets are up for a third consecutive day, and Wall Street analyst Tom Lee says it could be the start of a “face ripper rally” in U.S. stocks.

Lee, the head of research at Fundstrat and a notorious Wall Street bull, says he’s seeing growing signs of momentum in U.S. equities and expects stocks to now gain traction after falling into a correction earlier in March. A correction is defined as a decline of 10% or more from recent highs. However, after the rally that began on March 21, the benchmark S&P 500 index (SPX) is down only 6% from its February peak.

Lee adds that he is optimistic that a new round of U.S. tariffs scheduled for April 2 will be less severe than feared and will not be aggressively implemented by the administration of U.S. President Donald Trump. With tariff fears easing, there is little to hold U.S. stocks back in the near-term, says Lee.

Up and Away

“Trump’s recent comments signaled that many countries could receive tariff exemptions, confirming suspicions that the administration is primarily focused on negotiating better terms for the U.S.,” says Lee. “This tempering of trade war concerns alleviates one of the major market headwinds that had weighed on equities in recent weeks.”

Lee adds that he expects a V-shaped recovery in U.S. stocks amid growing signs of what’s being called a “Trump put,” which is the idea that the White House will change policies in the event that the stock market declines too much. Lee also noted that technical conditions for the U.S. stock market are improving as volatility subsides.

Is the Vanguard S&P 500 ETF a Buy?

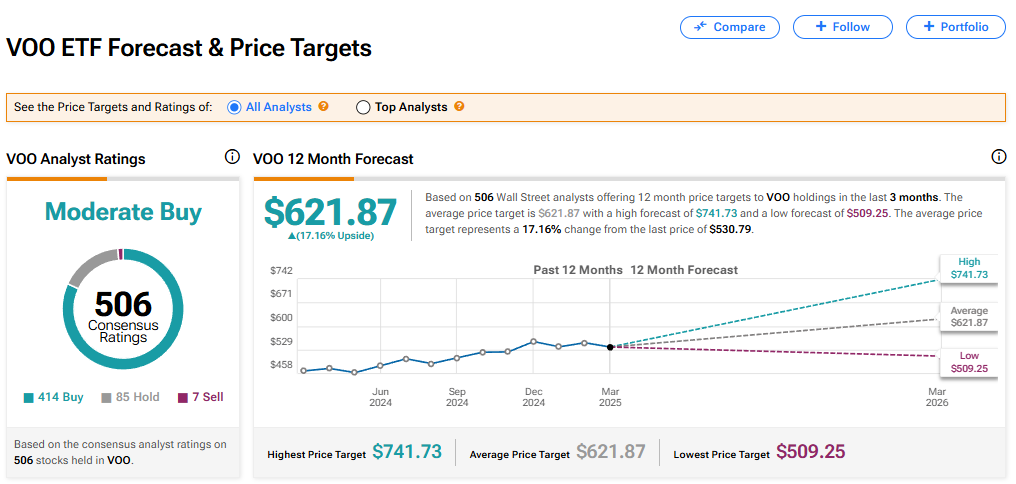

The Vanguard S&P 500 ETF (VOO), which tracks the movements of the benchmark U.S. stock index, has a consensus Moderate Buy rating among 506 Wall Street analysts. That rating is based on 414 Buy, 85 Hold, and seven Sell recommendations made in the last three months. The average VOO price target of $621.87 implies 17.16% upside from current levels.