Canaccord Genuity analyst George Gianarikas has reiterated a Buy rating on Rivian Automotive (RIVN) with a $21 price target as he believes the EV maker is heading into what could be a major year. Rivian’s 4Q25 deliveries were roughly in line with expectations, but Gianarikas said his optimism for 2026 “is undiminished.”

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The analyst noted that Rivian’s path since its IPO has been anything but smooth. Earnings estimates have steadily declined due to a tougher macro backdrop and shifting EV demand. Yet Gianarikas argues that the company’s key strengths, including its technology, vertically integrated approach, leadership team, and product quality, remain intact.

Rivian’s R2 May Drive a New Growth Wave

Gianarikas’s bullish view stems from the upcoming R2, Rivian’s more affordable electric SUV set to launch in the first half of 2026. The analyst calls the R2 the first model that truly reflects Rivian’s long‑term vision, a mass‑market EV with premium engineering.

The analyst compares Rivian’s opportunity to Tesla’s (TSLA) success with the Model 3 and Model Y, which opened the door to a larger customer base. He believes Rivian could tap into a similar pool of potential buyers in the U.S. alone, with Europe as the next big market.

2026 Seen as Potential Inflection Point

Beyond the R2, Gianarikas points to Rivian’s faster rollout of new autonomous‑driving features, which the company highlighted at its recent Autonomy & AI Day. The event made the analyst optimistic about Rivian’s future and how it plans to evolve from where it is today.

He believes the U.S. market is still waiting for a real mass‑market EV rival to Tesla. With traditional automakers pulling back on their EV plans, Rivian may have a rare chance to fill that gap and position itself as the clear No. 2.

Is RIVN Stock a Buy or Sell?

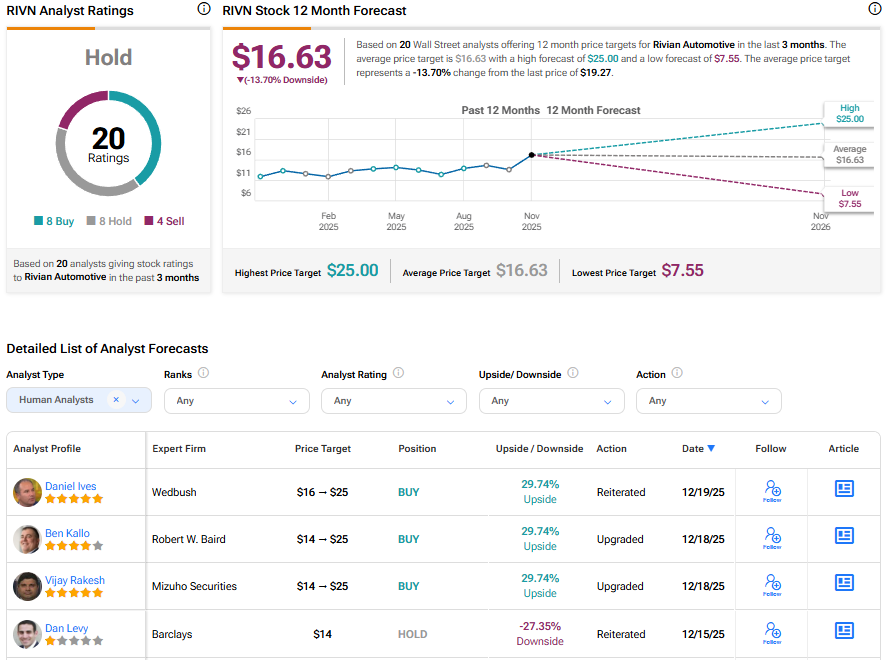

Turning to Wall Street, analysts have a Hold consensus rating on RIVN stock based on eight Buys, eight Holds, and four Sells assigned in the past three months, as indicated by the graphic below. Further, the average RIVN price target of $16.63 per share implies 13.9% downside risk.