General Motors Co. (NYSE: GM) has reported mixed results for the second quarter of 2022. The carmaker has missed earnings estimates, which also declined year-over-year. Meanwhile, the company was able to surpass revenue expectations.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Following the news, shares of General Motors declined 3.3% in the pre-market trading session, at the time of writing.

Q2 Results in Detail

Adjusted earnings of $1.14 per share compare unfavorably with the year-ago figure of $1.97 per share. The metric missed analysts’ expectations of $1.27 per share.

Revenues stood at $35.76 billion, up 4.7% year-over-year, surpassing the consensus estimate of $34.59 billion.

Earlier in July, General Motors informed its stakeholders that it sold 582,401 vehicles in the United States in the second quarter of 2022. The automobile maker witnessed third consecutive quarter of sequential market share gains.

The top line must have received support from a 29% year-over-year increase in commercial, government, and rental fleets in the second quarter of 2022.

Despite the COVID-19 resurgence in China, General Motors and its joint ventures delivered more than 484,000 vehicles in the country in the quarter.

GM Reiterates 2022 Outlook

General Motors expects to report adjusted EPS of $6.50-$7.50 in 2022. The consensus estimate for the same is pegged at $6.89 per share.

Net income is expected to be in the range of $9.6 billion to $11.2 billion, while adjusted operating income is anticipated between $13 billion and $15 billion.

Street Is Cautiously Optimistic about GM Stock

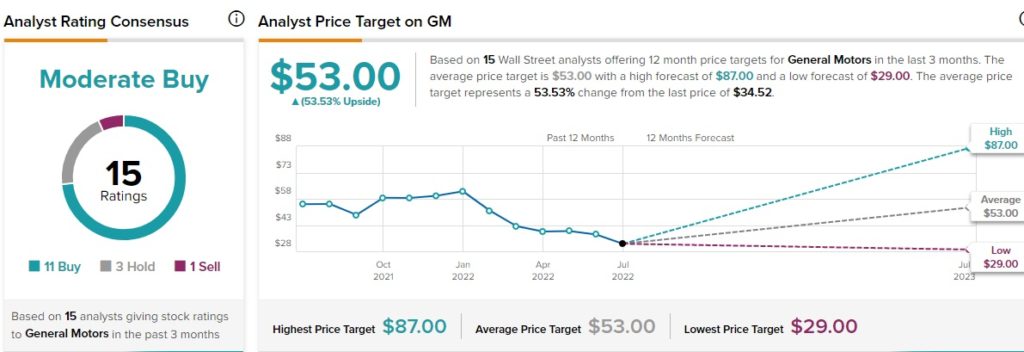

Overall, the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 11 Buys, three Holds, and one Sell. GM’s average price forecast of $53 signals that the stock may surge nearly 53.5% from current levels.

GM scores a 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform the market.

According to TipRanks, financial bloggers are 91% Bullish on General Motors, compared to the sector average of 63%. The news sentiment is also Positive for the stock.

GM’s Website Traffic Trends Hinted at Q2 Revenue Growth

TipRanks’ Website Traffic Tool offers insight into the possible impact of consumer behavior on General Motor’s quarterly performance. According to the tool, GM’s website recorded a 109.9% rise in global visits in June versus the same period last year.

Further, total projected worldwide visits on the company’s website rose 79.1% year-over-year in the second quarter, which is also visible in the year-over-year growth witnessed in the revenues for the reported quarter. Learn how Website Traffic can help you research your favorite stocks.

Other Developments at GM

Alongside earnings, General Motors announced a supply agreement with LG Chem, a South Korea-based chemical company. LG Chem will provide support to the company in meeting its rapidly rising EV production requirements. Through the long-term supply arrangement, LG Chem is expected to supply more than 950,000 tons of Cathode Active Material (CAM) to GM, starting from the second half of 2022 through 2030.

Meanwhile, General Motors informed its stakeholders about a key multi-year sourcing agreement with Livent, a chemical manufacturing company. Livent plans to supply GM battery-grade lithium hydroxide, produced majorly from lithium extracted at Livent’s brine-based operations in South America.

Concluding Thoughts

General Motor has witnessed strong revenue growth in the reported quarter despite supply-chain challenges. However, rising operating expenses might have impacted its bottom-line results.

The company is expected to keep struggling with low inventory, due to macroeconomic challenges. However, General Motor’s efforts to strengthen its footprint in the booming electric vehicle market make this stock an eligible pick for long-term investors.

Read full Disclosure