Tariffs are hitting General Motors (GM) like a wrecking ball. Last week, the automaker cut its profit forecast for 2025, citing tariff-related costs that could reach as much as $5 billion. Before the so-called trade war, GM expected adjusted earnings before interest and taxes (EBIT) to range between $13.7 billion and $15.7 billion. That forecast has been lowered to between $10 billion and $12.5 billion — a significant drop.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

While tariffs weigh on the entire auto industry, GM seems particularly exposed. As a result, I remain cautiously neutral on the stock for the long term, even though some of these risks may already be reflected in the price.

GM’s Creative Approach to Tariff Threats

According to analysts, consumers may soon be forced to pay 15-20% more for a new car, amounting to between $5,000 and $10,000 per vehicle, as producers pass on costs to consumers. Moreover, higher prices typically lead to decreased volumes. Meanwhile, used cars could see substantial price increases, and consumers could flee the new car market and settle for second-hand cars.

Automakers, including GM, are scrambling and getting creative in response to tariff threats. For instance, Ford (F) recently extended its “employee discount” to all U.S. customers, allowing consumers to take advantage of reduced car prices ordinarily afforded to its employees. In another example, Hyundai is promising not to raise prices on its current lineup of new cars for at least two months.

Since President Donald Trump effectively threatened U.S. automakers with penalties if they raise prices, car giants like GM have been put between a rock and a hard place. Moreover, the automotive industry is very competitive. All these companies offer similar products, and raising prices can quickly erode market share. Combine all this with high auto loan rates and dampened consumer confidence, and the U.S. auto sector has a huge multifactorial problem.

Why GM Is Particularly Vulnerable to Trade War Fallout

Unfortunately, GM is particularly vulnerable to tariffs compared to other automakers. It makes less than half of the vehicles it sells to U.S. customers domestically. Moreover, many of its production facilities are in Canada and Mexico, including its most profitable vehicles, like its full-size trucks (Silverado and Sierra). Lastly, GM derives a significant portion of its revenues from the U.S. market alone. For context, Ford’s revenues have a 67% exposure to the U.S. market.

GM’s Narrow Road

According to GM’s management, what was once America’s largest company has a plan. It is working with suppliers to increase U.S. content for higher compliance with the USMCA trade agreement. The company is also increasing production in its U.S.-based assembly plants. Also, GM is becoming more stingy with its cash, avoiding additional stock buybacks until the tariff smoke clears.

As for pricing, GM is taking a wait-and-see approach. Still, GM believes it can avoid passing higher costs off to consumers. Critically, GM, with its 92,000 American workers, has President Trump’s ear. It remains engaged in discussions and talks, which may already be bearing fruit. Days ago, the Trump administration signed an executive order to ease portions of the 25% tariffs on automobiles and auto parts. While this is a sign of good things to come, it is only a small and temporary reprieve.

Is GM Stock a Good Buy?

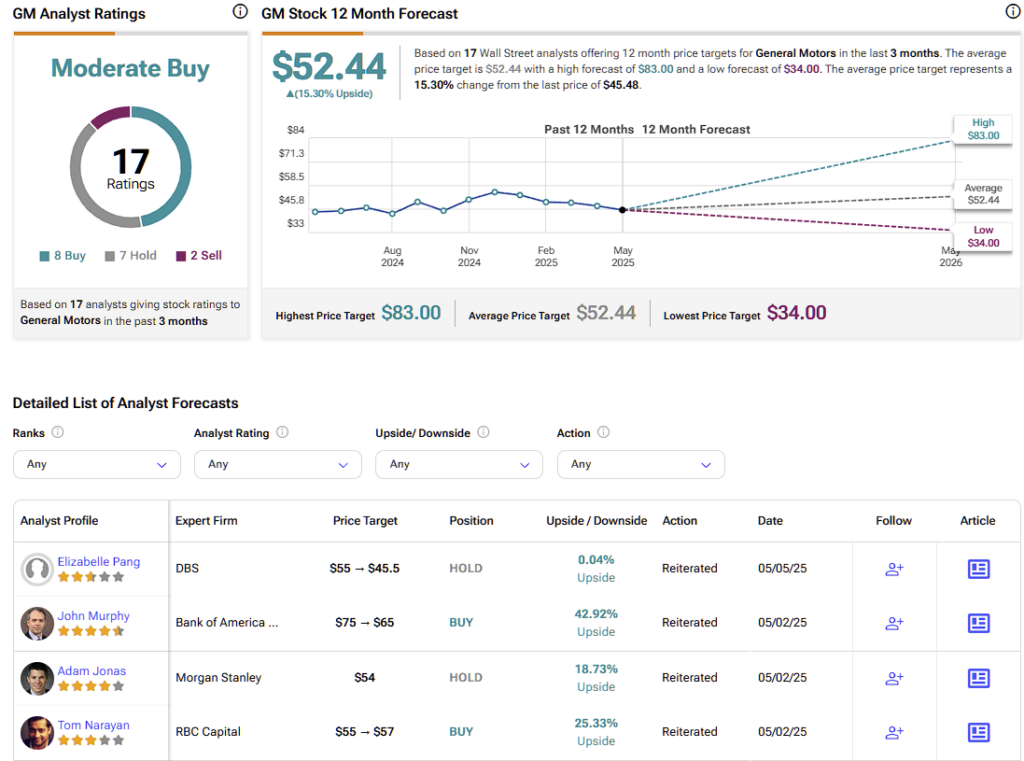

According to Wall Street, GM earns a Moderate Buy rating based on eight Buy, seven Hold, and two Sell ratings in the past three months. GM’s average price target of $52.44 implies a 15% upside potential in the next twelve months.

Last week, RBC Capital analyst Tom Narayan maintained an Outperform rating on GM and raised its price target to $57. He noted that GM’s revised full year 2025 guidance is a “worst case scenario where it absorbs 100% of tariffs as currently implemented.” He expects that some kind of deal will be reached that benefits GM.

On the other hand, Bank of America analyst John Murphy isn’t as confident in GM’s short-term prospects. Although he maintained a Buy rating, the analyst lowered GM’s price target from $75 to $65 due to the impact of tariffs.

So, Murphy is adjusting the “napkin math” on GM, while Narayan is making a speculative bet on political developments.

Avoiding Russian Roulette with GM Stock

GM faces a challenging balancing act as it navigates an unprecedented tariff environment. While tariffs contributed to a substantial downward revision in profit expectations, the strategy does confer some promise. Increasing U.S. production, enhancing domestic content, and maintaining dialogue with the Trump administration are pragmatic steps. However, investors should remain cautious.

GM faces a steeper climb than many competitors, and let’s not forget foreign peers. Foreign car makers could undercut U.S. companies on price by avoiding some American tariffs. Zooming out, the broader automotive industry is entering a period of transformation in that its production decisions will increasingly be influenced by geopolitical considerations rather than just economic efficiency. This is a lot to digest for these automotive companies that have done things the same way for decades.

While GM’s stock is down almost 15% year-to-date and its price-to-earnings ratio of 6.9 does not foretell a valuation risk, investors may be better off taking notes from GM’s playbook (a wait-and-see approach) before making significant investment decisions.