General Electric (NYSE:GE) has successfully completed the spin-off of its healthcare unit. The resulting entity, GE HealthCare Technologies (NASDAQ:GEHCV), has started trading on NASDAQ this week. The spin-off marks a big step in General Electric’s shift to an aviation-focused company. The company intends to retain only its Aviation business and rename it to GE Aerospace.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

General Electric secured approval for the spin-off from its board of directors in December 2022. Industry analyst Scott Davis expects GE Aerospace to enjoy an enterprise value of $94 billion, while GE HealthCare could likely be valued at around $48 billion. Davis thinks that “aerospace has obvious value” and will garner investor interest.

The former conglomerate is now left with two business segments — the Aviation unit and the combined operations of Renewable Energy and GE Powerjet engines (dealing in natural gas-powered turbines and wind turbines).

The once-profitable power business is now embroiled in a vicious cycle of losses, supply-chain issues, and concerns about its prospects as a fossil-fuel-dependent business.

Is GE a Buy, Hold, or Sell?

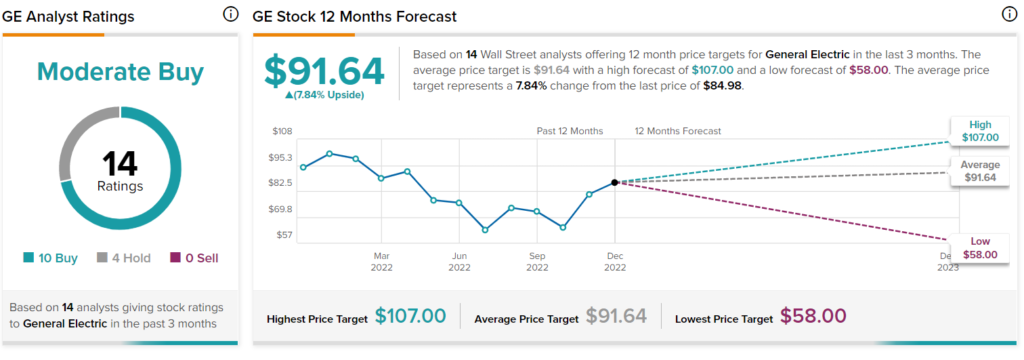

Wall Street is still slightly cautious about GE stock, with a Moderate Buy rating based on 10 Buys and four Holds. The average price target of $91.64 indicates a 7.84% upside potential to the current price.