Shares of U.S. aerospace company General Electric (GE) are down slightly ahead of the company’s Fiscal third-quarter financial results that are expected to be reported on October 22.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For Fiscal Q3, the consensus forecast of analysts is for GE to report earnings per share (EPS) of $1.14. That would represent 75% growth from earnings of $0.65 per share a year earlier. It’s worth noting that GE has beaten analysts’ earnings forecasts in the seven previous quarters.

Expectations are high for GE’s earnings after the company split itself into three separate publicly traded companies that also include GE HealthCare Technologies (GEHC) and energy business GE Vernova (GEV). General Electric retains the company’s traditional industrial business that is largely focused on making and repairing aircraft engines, as well as the ticker symbol “GE.”

GE stock has risen 90% so far this year amid bullish sentiment towards the company’s industrial business.

Bulls vs. Bears

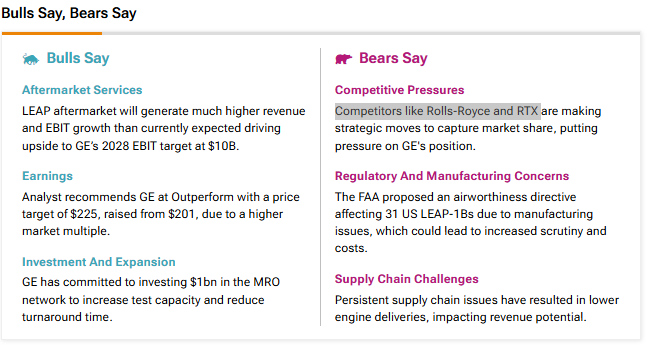

TipRanks Bulls Say, Bears Say tool provides insights into what analysts are saying leading into the Fiscal Q3 print by GE. Bulls like the ongoing investments that the company is making in its industrial operations, which they say should speed up turnaround times, notably on engine repairs.

On the other hand, bears caution that competitors such as Rolls-Royce (RYCEY) are gaining ground on GE, and that some supply chain issues could negatively impact the upcoming print. Another factor that could influence GE’s results is the ongoing machinist strike at commercial aircraft manufacturer Boeing (BA), which has largely shut down production at that company and led to a backlog of airplane deliveries.

Is GE Stock a Buy?

General Electric stock has a consensus Strong Buy rating among 11 Wall Street analysts. That rating is based on 11 Buy recommendations made in the last three months. There are no Hold or Sell ratings on the stock. The average GE price target of $209.64 implies 8.79% upside potential from current levels.