GE Aerospace (GE) stock jumped on Tuesday morning after the American aircraft engine supplier released its Q1 2025 earnings report. It began with adjusted earnings per share of $1.49, beating Wall Street’s estimate of $1.27. It also represented a 60% year-over-year increase from 82 cents per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Adding to GE Aerospace’s success was revenue of $9.9 billion, better than the $9.05 billion analysts expected. The company’s revenue also increased 11% compared to Q1 2024. That was thanks to $12.3 billion in total orders, which jumped 12% year-over-year.

GE stock was up 3.01% in pre-market trading this morning after falling 1.89% yesterday. The stock has also increased 7.13% year-to-date, making it one of the few winners in 2025, as trade wars and tariffs have weighed on the market.

GE Aerospace Guidance

GE Aerospace reiterated its 2025 guidance, including its adjusted EPS of $5.10 to $5.45 and low double-digit adjusted revenue growth. Wall Street’s 2025 estimates for GE include adjusted EPS of $5.42 alongside revenue of $39.44 billion.

GE Aerospace’s outlook also has it expecting operating profit of $7.8 billion to $8.2 billion and free cash flow of $6.3 billion to $6.8 billion. It noted it will be affected by tariffs, but will leverage trade programs and control costs to mitigate their impact. The company also said it expects full-year departures to grow low-single digits compared to its previous guidance of mid-single digits. This is due to it adopting “a more cautious approach and embedding a slower second half in our estimate.”

Is GE Stock a Buy, Sell, or Hold?

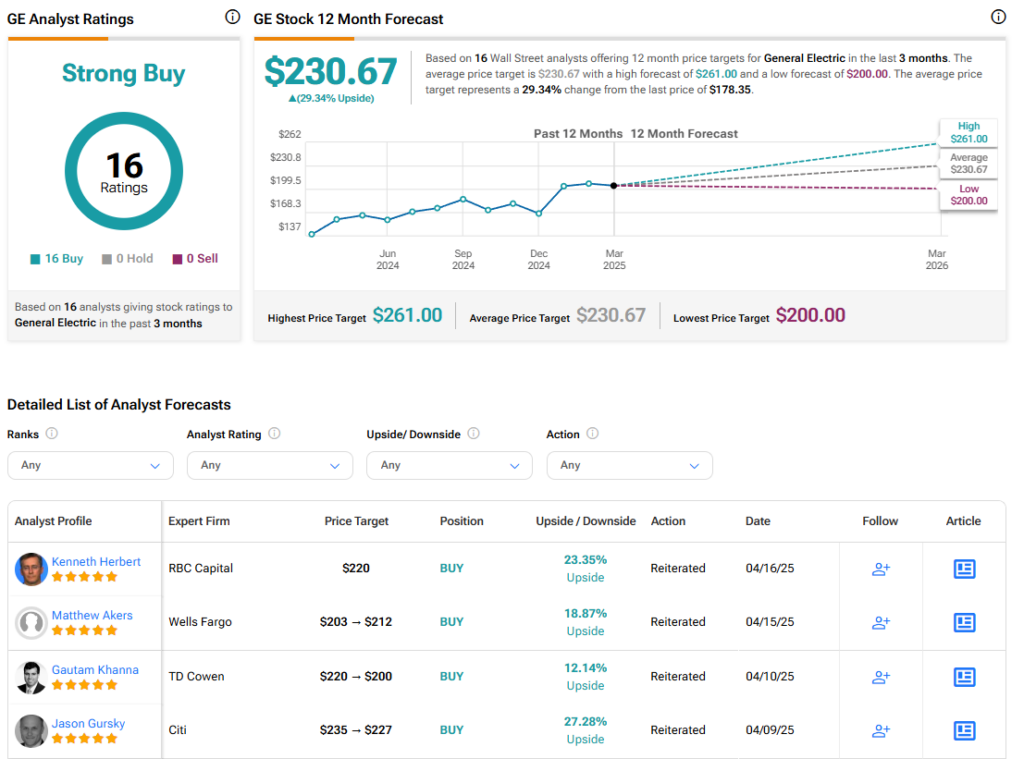

Turning to Wall Street, the analysts’ consensus estimate for GE Aerospace is Strong Buy, based on 16 Buy ratings over the last three months. With that comes an average price target of $230.67, representing a potential 29.34% upside for GE stock. These ratings and price targets will likely change as analysts update their coverage after today’s earnings.