GE Aerospace (GE) stock jumped on Thursday after the American aircraft company reported its Q2 2025 earnings. It started with adjusted earnings per share of $1.66, which beat Wall Street’s estimate of $1.43. It also represented a 38% year-over-year increase from $1.20.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Revenue reported by GE Aerospace was $11.02 billion, compared to analysts’ estimate of $9.59 billion. The company’s revenue also rose 21% from the $9.09 billion reported in Q2 2024. GE Aerospace Chairman and CEO H. Lawrence Culp, Jr., highlighted “free cash flow nearly doubling and more than 20% growth in orders, revenue, operating profit, and EPS.”

GE stock was up 0.26% in pre-market trading on Thursday, following a 0.57% gain yesterday. This extended the company’s 60.12% year-to-date rally and 67.23% climb over the past 12 months.

GE Aerospace Outlook

GE Aerospace updated its outlook in this earnings report. It now expects 2025 adjusted EPS to range from $5.60 to $5.80, compared to its previous guidance of $5.10 to $5.45. The company also raised its adjusted revenue growth guidance to be in the mid-teens instead of the low double digits. Wall Street’s estimates include adjusted EPS of $5.57 and revenue of $39.72 billion in 2025.

GE Aerospace also raised its guidance for 2028 in its latest earnings report. It predicts adjusted EPS of approximately $8.40, alongside double-digit CAGR from 2024 to 2028. It hadn’t previously provided an EPS estimate for this period, and its prior CAGR guidance was for a high-single-digit increase between 2025 and 2028.

Is GE Aerospace Stock a Buy, Sell, or Hold?

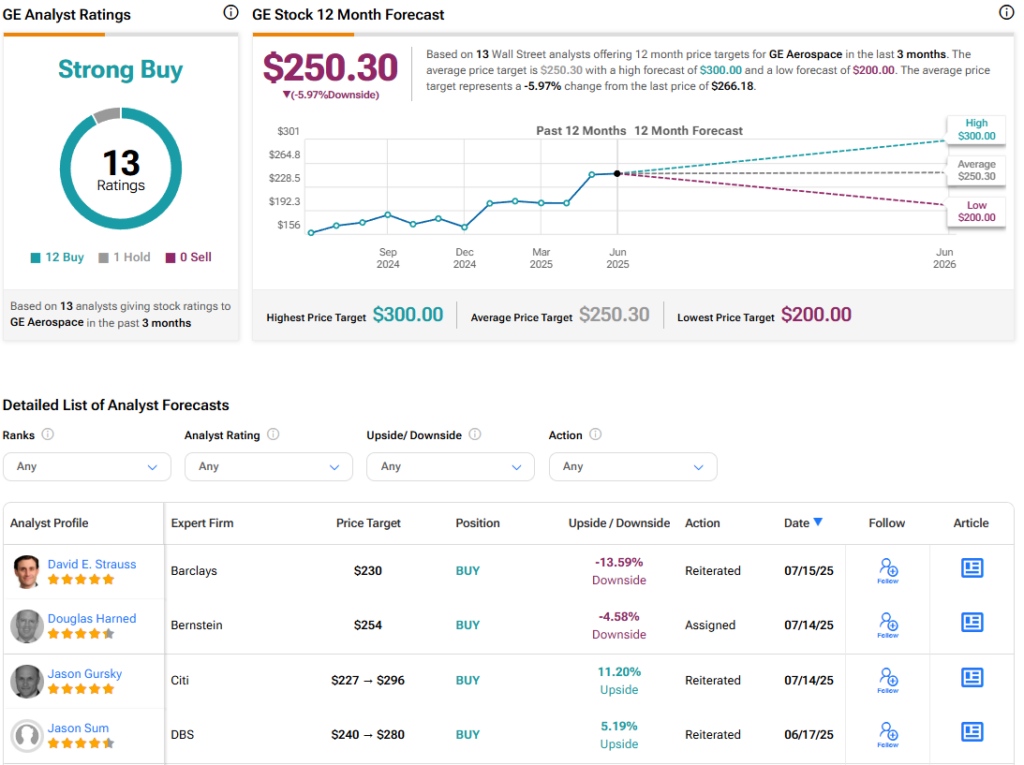

Turning to Wall Street, the analysts’ consensus rating for GE Aerospace is Strong Buy, based on 12 Buy and one Hold rating over the past 12 months. With that comes an average GE stock price target of $250.20, representing a potential 5.97% downside for the shares. These ratings and price targets will likely change as analysts update their coverage after today’s earnings report.