Shares of GE Aerospace (GE) gained in trading after the company raised its FY24 forecast and reported strong Q2 earnings. The aerospace company became an independent company this year following the spinoff of the GE conglomerate. GE reported adjusted earnings of $1.20 per share, up by 62% year-over-year, which was above analysts’ consensus estimate of $0.98 per share.

Details of GE’s Q2 Revenues

The company’s adjusted revenue increased by 4% year-over-year, with revenue hitting $8.2 billion. This missed analysts’ expectations of $8.44 billion. GE Aerospace’s total orders surged by 18% year-over-year to $11.2 billion.

However, supply constraints are hampering the company amid rising demand for its jet engines. In the second quarter, the company reported a 20% drop in new engine production.

GE’s Commercial Engines and Services business is a major contributor to the company’s revenues with a share of more than 70% in the second quarter. This business segment saw revenues of $6.1 billion in the second quarter, up by 7% year-over-year.

GE Bags AAL Order

In addition, GE Aerospace announced today that American Airlines (AAL) has ordered 180 CF34-8E engines, along with spares, for its fleet of 90 new Embraer 175 regional jets.

Russell Stokes, President and CEO, Commercial Engines and Services, GE Aerospace stated, “The CF34 engine has a long track record of success with American Airlines and we’re grateful the American team is putting its trust in us again.”

GE Aerospace Raised Its FY24 Outlook

Looking forward, management raised its FY24 outlook and now expects its adjusted earnings per share to be in the range of $3.95 to $4.20. For reference, analysts were expecting an adjusted EPS of $4.08. However, the company trimmed its revenue outlook, citing expectations of lower engine output. GE now anticipates adjusted revenue to grow in the “high single digits,” compared to its prior forecast of “low double digits.”

Is GE a Good Stock to Buy Right Now?

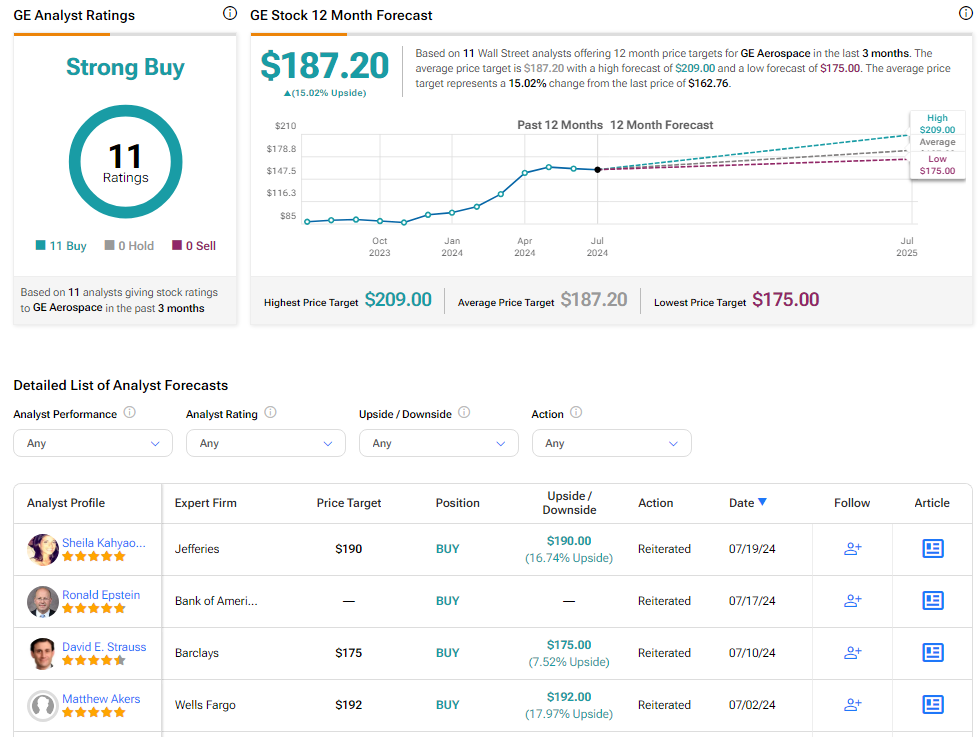

Analysts remain bullish about GE stock, with a Strong Buy consensus rating based on a unanimous 11 Buys. Over the past year, GE has increased by more than 80%, and the average GE price target of $187.20 implies an upside potential of 15% from current levels. These analyst ratings are likely to change following GE’s results today.