American aircraft engine supplier GE Aerospace (GE), formerly General Electric, is finally close to finishing a lawsuit with investors after reaching a settlement agreement. The settlement will have it pay $362.5 million in cash to affected traders, with lawyers getting a potential 25% cut of that payout.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

The crux of this lawsuit is the alleged misleading disclosures posted by the company from February 2016 to January 2018. The lawsuit argued that GE failed to present proper data concerning its GE Power unit, leaving investors more exposed than the company’s disclosures implied. As part of the settlement, GE and prior Chief Financial Officer Jeffrey Bornstein have denied any wrongdoing.

Investors will note that GE Aerospace has undergone some major changes since this lawsuit was filed. The company has pivoted to focus on its aircraft engine business. That saw it spin off its healthcare business into GE Healthcare (GEHC) and its energy and power business into GE Vernova (GEV) back in April.

What This Means for GE Stock

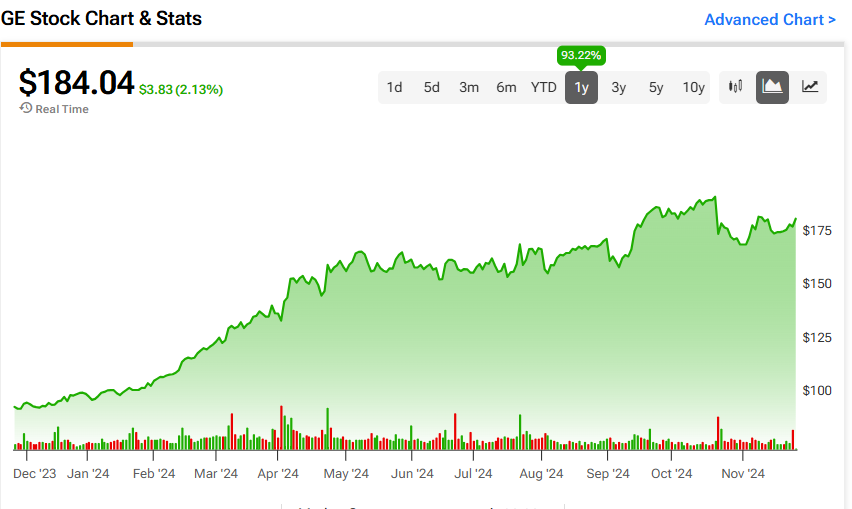

GE Aerospace shareholders appear satisfied with the result of this lawsuit. Considering the litigation has been underway since 2017, they are no doubt ready to have the shadow of it out from over them. With that comes a rally for GE stock, pushing the shares 2% higher as of this writing.

The latest boost for GE stock bolsters an already strong performance. Indeed, the company’s shares are up 81.51% year-to-date and 93.22% over the last 12 months.

Is GE Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for GE Aerospace is a Strong Buy based on 11 Buy ratings over the last three months. With that comes an average price target of $211.45, a high of $235, and a low of $190. This represents a potential upside of 15% for GE shares.