For over five years, GameStop (GME) has moved beyond its roots as a traditional brick-and-mortar video game retailer. Its transformation began in 2021, when the meme-stock phenomenon catapulted the company into financial headlines and dramatically reshaped its investor base. Since then, GameStop has remained one of the most polarizing stocks in the market, driven by retail investor enthusiasm and a leadership overhaul led by activist investor-turned-CEO Ryan Cohen, who aimed to revitalize a business facing consistent losses and declining relevance.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

As of 2025, the company has eked out a modest profit and built a substantial cash reserve, largely through opportunistic equity offerings that capitalized on retail-driven momentum. GameStop is now pivoting toward digital assets, including a sizable bet on Bitcoin, supported by a recent $1.3 billion convertible bond issuance.

Despite these bold moves, the company’s core fundamentals remain uncertain. Revenue continues to decline, and its valuation remains difficult to justify through traditional financial metrics. Cohen, until recently, has maintained a low public profile, while insider buying activity has subtly supported ongoing investor interest.

In my view, this highly unconventional situation—where the fundamentals are neither weak enough to justify a sharp sell-off nor strong enough to support a clear long-term value thesis—makes it difficult to adopt a definitive stance. As such, I’m maintaining a Hold rating for now.

The CEO Who Finally Spoke

Far from standard practice for a mid-cap publicly traded company, GameStop CEO Ryan Cohen rarely speaks publicly. Since taking the helm, he’s never hosted an earnings call and has only given one interview since 2023. More recently, though, Cohen sat down for a rare conversation with crypto-focused media outlet The Crypto Times.

In the interview, Ryan Cohen offered a candid assessment of GameStop’s past, acknowledging that the company was in poor financial condition and experiencing significant losses when he first became involved. He attributed much of the decline to the broader industry shift from physical game sales to digital downloads—a trend that severely impacted GameStop’s legacy business model.

To reverse the company’s trajectory, Cohen and his team implemented aggressive cost-cutting measures and instilled greater fiscal discipline. The strategy appears to have paid off: in Fiscal 2024, GameStop reversed a $313 million net loss from the prior year and reported a modest profit of $6.7 million. By Fiscal 2025, the company posted net income of $131.3 million, with operations approaching breakeven margins.

Cohen also emphasized GameStop’s strategic pivot toward collectibles, particularly in the trading card segment, spanning both sports and trading card games (TCGs). Most notably, he underscored that GameStop has become a leaner and more profitable retailer, despite the continued decline in quarterly revenue.

One of the more revealing aspects of the interview was Cohen’s candid account of his years-long battle to reshape the company. He made it clear that cleaning house—both at the executive and board levels—was critical to realigning GameStop with long-term shareholder interests. “We got rid of all of that nonsense, and we focused on running the business profitably,” he said.

Since becoming GameStop’s largest shareholder in 2020, Ryan Cohen has played a central role in reshaping the company’s leadership. He led a complete overhaul of the board, facilitated the departure of then-CEO George Sherman, supported the appointment of Matt Furlong as his successor, and ultimately assumed the CEO role himself in 2023.

Meme Hype, Net Cash, and Bitcoin Bets

As much as skeptics may be reluctant to acknowledge it, GameStop’s management has made meaningful progress in steering the company toward profitability, despite significant challenges. Perhaps even more noteworthy is how Ryan Cohen and his team have successfully managed the complexities of the meme-stock phenomenon. Rather than resisting the volatility, they capitalized on it—executing timely equity offerings during momentum-driven rallies, such as those triggered by high-profile events like YouTuber Keith “Roaring Kitty” Gill disclosing a sizable stake in the stock.

In FY 2024 alone, GameStop raised an impressive $3.45 billion through stock sales, resulting in substantial shareholder dilution—nearly 50%, including that of Cohen himself. Prior to the offering, the company held a net cash position, with $921 million in cash against $616 million in debt. Following the capital raise, GameStop’s net cash position rose sharply to $4.36 billion, according to its most recent filings.

Following that, Cohen made a pivotal—though largely quiet—change to GameStop’s strategy by revising the company’s investment policy. Previously limited to fixed-income securities, the updated policy now permits broader equity investments, all under Cohen’s direct oversight. This strategic shift set the stage for a bold move: an allocation to Bitcoin. As of the latest filings, GameStop holds 4,710 bitcoins, currently valued at approximately $513 million.

In a recent interview, Cohen outlined his rationale, describing Bitcoin as a modern hedge against global currency debasement and systemic financial risk, similar to gold, but with distinct advantages. Unlike gold, he argued, Bitcoin offers superior portability, greater transparency, and more long-term upside. While gold’s market capitalization hovers around $20 trillion, Bitcoin’s remains under $2 trillion. Cohen also emphasized that the decision was his own, stating clearly that he’s not following anyone else’s playbook.

A Calculated Dilution for Strategic Growth

Back in March, GameStop announced a $1.3 billion private offering of convertible senior notes to be used for general corporate purposes, including buying more Bitcoin, somewhat following the playbook of companies like MicroStrategy (MSTR) when it comes to strategic moves to acquire Bitcoin.

Instead of issuing traditional debt with fixed interest obligations, GameStop opted for convertible bonds—securities that allow investors to convert their holdings into equity. Each $1,000 bond can be converted into 33.4970 shares, implying a conversion price of approximately $29.85. Should the stock rise significantly above that level, bondholders are likely to convert, capturing upside potential while diluting existing shareholders.

Notably, the bonds include no lock-up restrictions, meaning conversions can occur as soon as they become economically advantageous. This feature could contribute to added share dilution during rallies, potentially amplifying stock volatility. While this structure may put some pressure on near-term share performance, it provides GameStop with meaningful financial flexibility, thereby enhancing cash flow and avoiding the recurring burden of fixed interest payments. In essence, it’s a strategic trade-off that Ryan Cohen appears willing to embrace in pursuit of long-term optionality.

Is GameStop a Good Stock to Buy?

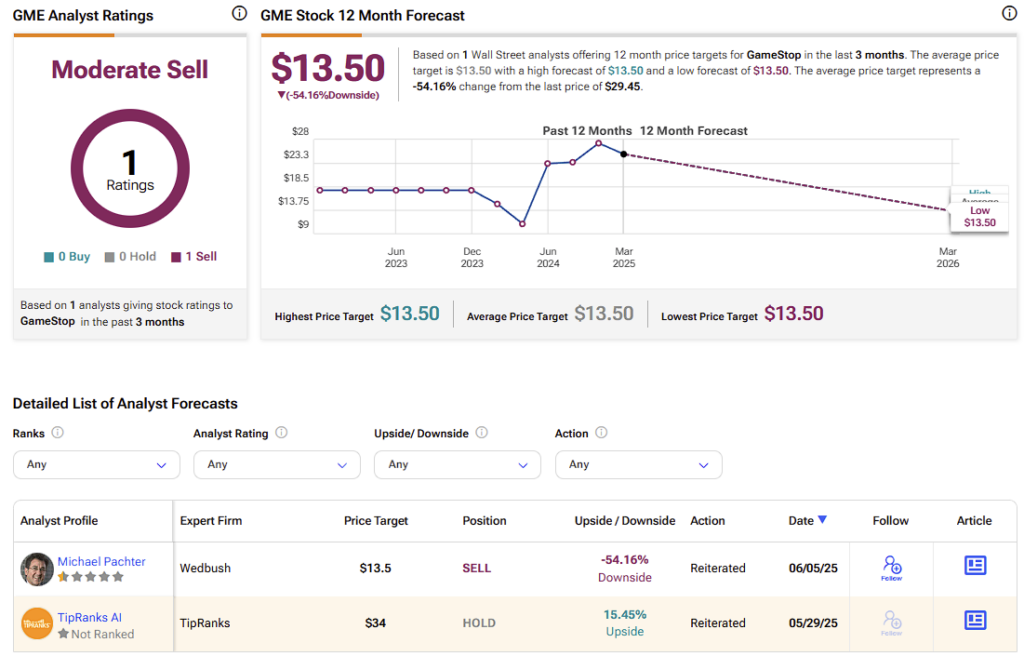

Given the highly unconventional nature of GameStop’s evolving fundamentals, most Wall Street analysts have largely stepped away from covering the stock. One of the few remaining voices is longtime skeptic Michael Pachter of Wedbush, who continues to maintain a Sell rating. In April, following the announcement of GameStop’s Bitcoin investment, Pachter modestly raised his price target to $13.50 per share following the news that GameStop had invested in Bitcoin.

GameStop’s Remains a Puzzle Bears Just Can’t Solve

GameStop remains a company whose current market valuation—over $13.6 billion—is difficult to justify based on its underlying business fundamentals. Revenue continues to decline annually, operations are hovering around breakeven, and the company lacks a clearly defined strategy for long-term value creation beyond cost-cutting and opportunistic investments, such as its recent move into Bitcoin. If assigning a valuation, one could argue that the company’s equity is largely supported by its sizable net cash position, with a modest premium for its gradually diminishing core business.

That said, a mix of lingering—albeit more subdued—retail investor enthusiasm, an unconventional leadership approach, a bold Bitcoin allocation, and insider share purchases with limited disclosure have helped keep the stock trading at elevated levels. In a market where sentiment can override fundamentals, the stock remains unpredictable and difficult for bearish investors to challenge. Given the speculative nature of this setup and the absence of strong fundamental support, I’m maintaining a Hold rating.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue