GameStop (GME) shares climbed 5.07% to $23.63 on Thursday, even though the video game retailer released no new updates. The rally came as traders piled into bullish call options, betting that the stock will rise further in the short term.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

As of Thursday’s close, trading volume in GameStop call options topped 233,000 contracts, about 100,000 more than the stock’s average daily volume over the past 20 sessions. The put/call ratio fell to 0.1, meaning call options heavily outweighed puts and showing that traders were firmly betting on more upside. It was the stock’s lowest ratio since July 21, reflecting strong bullish sentiment.

Traders Target Short-Term Strikes

Options with $23.50 and $24 strike prices, set to expire this Friday, saw the most trading activity. This suggests that traders expect more upside in the next few days. Heavy call buying can also push the stock higher as market makers buy shares to cover their positions, a pattern that has often lifted GameStop during past rallies.

Momentum Returns, But Nothing Has Changed Fundamentally

Despite the jump in trading, there is no fresh company news driving the move. GameStop last reported earnings in September, showing a smaller-than-expected loss. For its Fiscal second quarter, GameStop announced earnings per share (EPS) of $0.25, which topped the $0.19 consensus expectation of analysts. Revenue in the quarter totaled $972.2 million, ahead of the $900 million that had been forecast on Wall Street.

Looking ahead, Wall Street expects GameStop to report EPS (earnings per share) of $0.20 for Q3 FY25, marking a significant jump from $0.06 in the prior-year quarter. Meanwhile, revenue is estimated to increase by about 15% to $987.3 million.

Is GameStop Stock a Buy, Sell, or Hold?

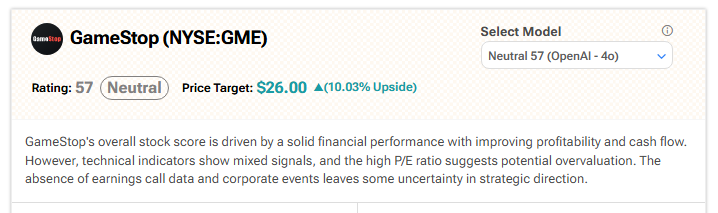

Turning to Wall Street, analyst coverage of GameStop is limited. Fortunately, TipRanks’ AI analyst Spark has it covered. Spark rates GME stock an Neutral (57) with a $26 price target. The rating reflects GameStop’s solid financial performance, offset by mixed technical signals and a high P/E ratio that suggests possible overvaluation.