Shares of GameStop (NYSE:GME) are little changed in after-hours trading after the company reported earnings for its third quarter of Fiscal Year 2023. Earnings per share came in close to breakeven, which beat analysts’ consensus estimate of -$0.08 per share.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Sales decreased by 9.2% year-over-year, with revenue hitting $1.08 billion. This missed analysts’ expectations by $100 million.

Notably, SG&A expenses decreased to $296.5 million from the $387.9 million seen in the year-ago quarter. This equates to 27.5% of sales versus 32.7% in Q3 2022. In addition, the company had $1.210 billion in cash and equivalents at the end of the quarter.

Is GME Stock a Buy, Sell, or Hold?

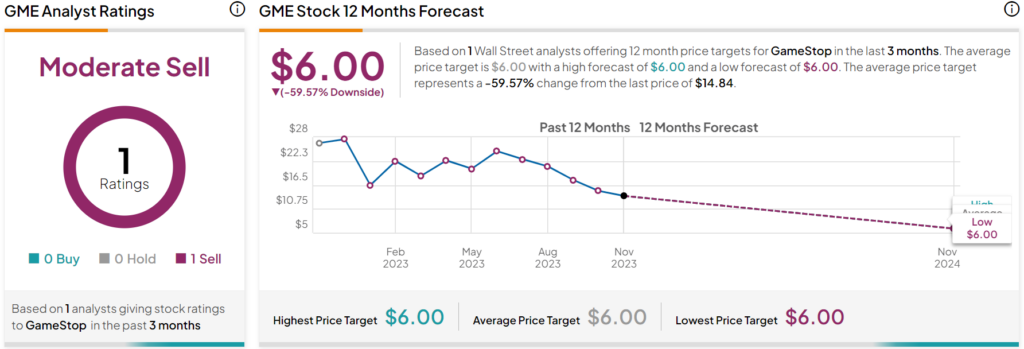

Turning to Wall Street, only one analyst, Michael Pachter, is covering GME stock and has assigned a Sell rating. After losing one-third of its value over the past year, Pachter’s $6 price target implies almost 60% downside risk from current levels.